Commodity supercycle still firmly intact, amid long-term supply challenges.

Key points

- Uncertainty about China is weighing on commodity sentiment.

- Growth in renewables is boosting demand for some metals.

- Lack of investment in new projects will also support commodity prices.

- Key resource positions in the Fund include oil, met coal and copper companies.

By Kevin Bertoli, PM Capital

Introduction

PM Capital is often asked for its view on the commodities supercycle. Companies that produce energy and industrial metals had a combined 29% weighting in the PM Capital Global Companies Fund at end-July 2023. Our positions in copper, oil and coal companies have contributed to the Fund’s strong performance.1

Lately, weakness in China’s economy has prompted more questions on the commodities supercycle. A rule of thumb in commodity markets is that China consumes ‘half of everything’, although it varies by commodity. Thus, a slowing Chinese economy weighs on commodity demand and commodity prices.

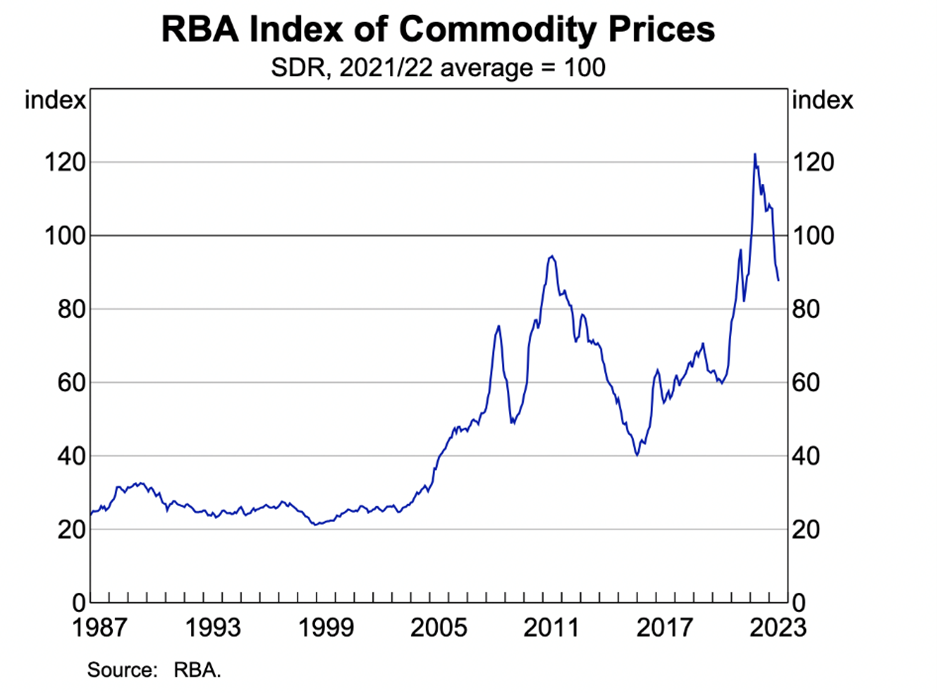

The Reserve Bank Index of Commodity Prices has fallen from a peak of 118 in June 2022 to 91 in July 2023, as the Chart 1 below shows:

Chart 1: Commodity prices (AUD)

Other factors this year have also affected commodity sentiment. Global economic growth has fallen as central banks lifted interest rates to fight inflation. The International Monetary Fund forecasts global economic growth to fall from 3.5% in 2022 to 3% in 2023 and 20242, which is weak by historical standards. Sluggish global growth will affect commodities demand.

Moreover, commodity prices are coming off an inflated base from COVID-19. As countries went into lockdown, supply-chain bottlenecks during the pandemic hurt commodity production and supply, driving prices sharply higher. This year’s retreat in commodity prices must be viewed within that context.

Last year, PM Capital outlined four reasons why the commodity supercycle is intact and why the Fund maintains a large position in resources.3 They were: geopolitical factors (Russia’s war on Ukraine); reduced capital investment in new projects; mining complexity (new copper mines, for example, are getting harder to find and develop); and new demand drivers (principally, renewables).

We stand by that view. As a patient long-term investor, PM Capital is assessing the commodity supercycle over the next five-10 years. Current market action is important, but commodity prices can be volatile in the short term. Spot commodity prices shift from day to day, affecting prices for resource companies.

A recurring message from PM Capital is to beware of ‘market noise’ and focus on what matters most: company valuation. We view current volatility in commodity prices as an opportunity to buy quality resource producers at lower prices.

Here is a brief update on PM Capital’s view on the commodity supercycle:

1. China and global demand

In July 2023, China reported second-quarter GDP growth of 6.3% from a year ago, below expectation. China’s economy grew just 0.8% in the June quarter, compared to 2.2% in the first quarter. Problems in its property sector, high youth unemployment and slowing retail sales are sapping confidence in China.

Long term, fears are growing that China’s ageing population will become a bigger drag on growth. One scenario is China following the experience of Japan, which has battled anaemic growth for years due to its ageing population. But China (a command-controlled economy) lacks the agility of Japan’s open economy.

These are valid concerns. However, China in early August flagged the possibility of additional fiscal stimulus and policy support to aid economic growth. Although the size, timing and effectiveness of any stimulus is uncertain, China has a history of injecting larger fiscal stimulus into its economy when needed.

As China slows, improving fundamentals in developed markets could support commodity markets. Global inflation is retreating; interest rates appear to have peaked; and the United States dollar is starting to decline as investors pare back interest-rate expectations.4 These factors are positive for commodities.

2. Emerging sources of demand

In 2019, PM Capital initiated a position in copper companies. Similar to today, the market then focused on China’s problems: slowing economic growth, the US-China trade dispute and risks in Chinese property. PM Capital favoured copper due to growth in renewables and shortages in new supply. Copper became a successful position for the Fund.

We saw renewables as an important new demand driver for copper and other metals. Copper is an essential material in Electric Vehicles (EVs) due to its use in batteries, electric motors, charging stations and other areas. Copper is also used in renewable-energy systems that generate power from wind, solar and hydro.

As developed nations move faster to decarbonise their economies, demand for renewables – materials like copper – will rise. This structural trend has decades of growth ahead given the scale of the decarbonisation challenge.

In 2021, the International Energy Agency (IEA) forecast that US$5 trillion of annual investment in clean energy will be required by 203o under the pathway for net-zero carbon emissions.5 That will add an extra 0.4% to annual global GDP.

For copper, the IEA estimated that demand will be 1,7-2.7 times greater over the next decade and a half due to the clean-energy transition, including renewables, EVs and energy-grid investment.6

Clearly, renewables will become a stronger source of new minerals demand over this decade and beyond – and a large source of economic growth, such is the amount of investment required to decarbonise economies.

Growth in developing nations will also drive commodities demand this decade. As investors focus on China’s slowing economy and its effect principally on iron-ore demand, they risk overlooking growth in steel production in India. In July 2023, BHP Group estimated that annual steel production in India could increase from around 100 million tonnes in 2020 to almost 400 million tonnes by 2050.7 Iron-ore and metallurgical coal are essential minerals for steel production.

S&P Global, a ratings house, predicts India will become the world’s third-largest economy by 2030, overtaking Japan and Germany.8 So, as China slows, other sources of commodity demand from developing nations are strengthening,

3. Supply constraints

As mentioned earlier, PM Capital’s position in copper was partly driven by the lack of new supply coming to market. Copper projects were becoming more complex, taking longer to build and requiring greater capital. A higher copper price was needed to incentivise companies to invest in new copper supply.

In May 2023, BHP noted that the copper industry requires US$250 billion of investment in new supply between 2022 and 2030 to meet increased demand from renewables and EVs. But committed new copper projects total well below 50% of that figure.9 Although a higher copper price will encourage greater investment in copper projects, it takes years to develop new copper supply to meet rising demand and offset natural depletion.

Today, we continue to see project pipelines for new copper mines pushed out and higher capital expenditure budgets required. Codelco, the world’s largest copper producer after Freeport McMoRan, is spending more than US$40 billion in the next six years just to maintain current production levels. Southern Copper, the fourth-largest producer, recently pushed out its development pipeline by 2-3 years for several projects, with most now due after 2030.

Other factors are also constraining investment and supply in new mining projects. As institutional investors put more weight on Environmental, Social and Governance (ESG) factors in investment decisions, large mining companies are increasingly moving away from fossil fuels through divestments of existing assets or less investment in fossil-fuel exploration. Issues with approvals for new fossil-fuel projects and sourcing external capital are compounding supply challenges.

As with other commodities, oil and met coal have been affected by market fears of slowing Chinese demand. Yet oil and met coal also benefit from emerging demand sources in the medium term. India’s steel mills, for example, almost fully rely on imported met coal. As we noted earlier, steel demand in India is rising rapidly. The India Steel Association expects 25-30% growth in steel capacity over 3-4 years to. The sector’s blast furnaces need met coal.

4. Selected resource positions

The Fund continues to maintain investments in met coal, oil and copper producers – and has taken advantage of volatility in commodity prices and resource stocks to add new resource positions.

In met coal, Stanmore Resources is a key position. Stanmore, a low-cost producer, has three coal mines in Queensland and no debt. Stanmore completed its acquisition of BHP Group’s 80% interest in BHP Mitsui Coal in May 2022. That left Stanmore well-positioned to benefit from higher coal prices.

In energy, we maintain a position in CNOOC, the largest Chinese oil and gas producer. CNOOC is in the lowest quartile for production costs, trades on a Price Earnings (PE) of about 5 times and is expected to yield 8% at its current share price.

In copper, valuation anomalies are not as obvious as they were in 2019 due to key copper stocks rallying in the past few years, including several in the Fund. We recently added Grupo Mexico, which has an 89% stake in Southern Copper (a large, listed copper producer with low-cost mines) and a 70% stake in Mexico’s largest rail operator. At US$4 a pound for copper, Grupo Mexico trades on about 12 times earnings and should yield above 5%.

Conclusion

This analysis reinforces the opportunities that emerge when markets over-react to short-term news – in this case, China’s slowing economy. All too often, investors base their decisions on top-down macroeconomic forecasts and ignore company valuation and longer-term industry trends.

China has a critical role in commodities demand and its economy has several short- and long-term threats. But viewing Chinese commodities demand in isolation risks overlooking other positives: new sources of demand from clean-energy investments; rising demand from India and other developing nations; and supply constraints for copper, oil and met coal, which continue to worsen.

About the author

Kevin Bertoli is a co-portfolio manager of the PM Capital Global Companies Fund and PM Capital Australian Companies Fund. See more PM Capital insights here.

Notes:

1The PM Capital Global Companies Fund returned 30.2% over one year to end-June 2023. The return on its benchmark MSCI World Net Total Return Index (AUD) over that period was 22.4%.

2International Monetary Fund (2023). “World Economic Outlook Update”. July 2023.

3PM Capital, “Four Factors Driving the Next Commodities Supercycle”, SIAA Monthly 2022.

4Reflected by the US Dollar Index year-to-date. At 31 August 2021.

5International Energy Agency, “Net Zero 2050”, May 2021.

6International Energy Agency, “Net Zero 2050”, May 2021.

7Dr Huw McKay, BHP, “India: The World’s Leading Growth Story”. The Times of India. 21 July 2023.

8S&P Global, “Outlook for India’s economic growth policy and platforms”. 21 November 2022.

9BHP, “Bank of America 2023 Global Metals, Mining and Steel Conference.” 16 May 2023.

This insight is issued by PM Capital Limited ABN 69 083 644 731 AFSL 230222 as responsible entity for the PM Capital Global Companies Fund (ARSN 092 434 618), the "Fund". It contains summary information only to provide an insight into how we make our investment decisions. This information does not constitute advice or a recommendation, and is subject to change without notice. It does not take into account the objectives, financial situation or needs of any investor which should be considered before investing. Investors should consider the Target Market Determinations and the current Product Disclosure Statement (which are available from us), and obtain their own financial advice, prior to making an investment. The PDS explains how the Fund's Net Asset Value are calculated. Past performance is not a reliable guide to future performance and the capital and income of any investment may go down as well as up.