As the market focuses on Eurozone recession, a recovery in its banking sector continues.

Key points

- By sector, European and UK banks have the largest allocation in the PM Capital Global Companies Fund (18%)1. Key holdings include ING Groep (The Netherlands), Bank of Ireland Group, CaixaBank (Spain) and Lloyds Banking Group (UK)2.

- PM Capital has consistently said that Eureopan banks are the most undervalued sector in global equity markets today.3

- Our conviction is based on an expected long-term recovery in European bank earnings and dividends, underpinned by rising European interest rates.

By John Whelan, PM Capital

In 2020 and 2021, PM Capital increased its position in European banks. After underperforming for a decade, European banks traded at bottom-quartile valuations.

At the time, valuations of European banks substantially lagged peer valuations in the United States and Australia. Larger falls in European interest rates and tighter industry regulation (compared to the US) weighed on Europe’s banking sector.

European banks were among the hardest hit by falling rates. Remarkably, the European Central Bank had negative interest rates until July this year.

Market sentiment towards European banks was poor. Russia’s invasion of Ukraine in February 2022, soaring energy prices and fears of Eurozone recession alarmed investors. They feared a recession would trigger bad debts in Europe.

However, the flipside is that European banks are a key beneficiary when interest rates rise (through their expanding Net Interest Margins). European banks are the most sensitive sector globally to higher interest rates.

In early 2022, PM Capital believed rising inflation was not a transitory response to the COVID-19 pandemic.4 We expected higher inflation would “force central banks to lift rates sooner and more aggressively than the market expected”.5

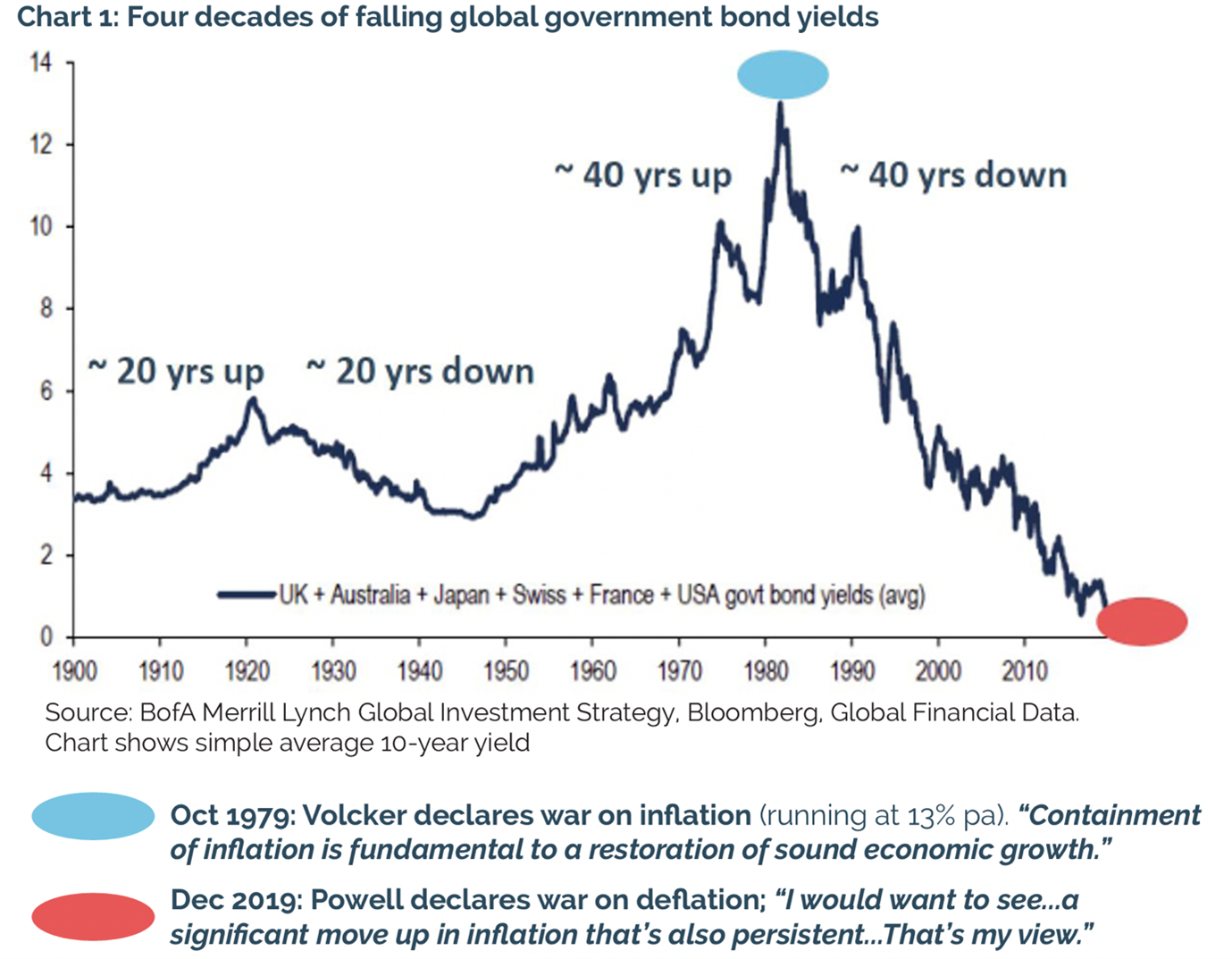

That has been the case. Surging inflation in developed economies this year has exceeded market expectation. Central banks have responded with the fastest pace of rate rises in decades. After four decades of falling government bond yields, the tide has turned.

Higher interest rates boost bank Net Interest Margins (the amount a bank earns on loans compared to the amount it pays on deposits). That’s good for bank earnings.

Analysis by UBS, an investment bank, shows a 1% increase in interest rates equates to around a 25% increase in European bank earnings, on average.6

In July 2022, the European Central Bank raised interest rates for the first time since 2011 to tackle inflation. The ECB’s 0.5% increase was followed by a record 0.75% increase in September 2022. The ECB has flagged more rate hikes.7

After lagging other central banks with rate rises, the ECB is playing catch-up. In market parlance, the ECB has been “behind the curve”. The market expects European rates to increase until 2024.8 That suggests a multi-year tailwind of rising interest rates and expanding Net Interest Margins for European banks.

As earnings recover, PM Capital expects European banks to return more capital to shareholders through rising dividends and the continuation of share buybacks. The average dividend yield from European banks is currently substantially higher than that for European equities9. This yield could contribute to a re-rating in European bank stocks, in time.

Bank results encouraging

Latest results from European banks support our investment thesis for the sector. European banks held in the PM Capital Global Companies Fund have mostly reported an expansion in Net Interest Margins, improving earnings and higher dividends.

In late July, CaxiaBank reported a slight improvement in its Net Interest Margin for the second-quarter of 2022.10 CaxiaBank noted higher revenues, cost savings and lower impairment charges for bad debts.

Also in July, Lloyds Banking Group reported a Net Interest Margin of 2.77% in its half-year 2022 result, up from 2.5% for the same half a year earlier.11 Lloyds said its Net Interest Margin benefitted from UK interest rate increases.

In its guidance, Lloyds said it expects its Net Interest Margin to be greater than 2.8% for 2022. Lloyds is ahead of European banks (in terms of benefitting from higher interest rates) because the Bank of England raised rates earlier.

PM Capital expects Lloyds to return more than 10% of its market capitalisation to shareholders this year through dividends and its share buyback. That figure could grow as Lloyds increase its earnings as its Net Interest Margin expands.

In August, Bank of Ireland reported a modestly higher Net Interest Income in its interim result for 2022 and expects that trend to continue for the full year.12

Bank of Ireland shares have recently rallied13, buoyed by market expectations for rising European interest rates. Our analysis suggests a 1% move in rates equates to around a 35% increase in Bank of Ireland’s earnings.

Also in August, ING reported a slight fall in Net Interest Margin for the second quarter of 2022.14 ING has less sensitivity to interest rates compared to the average European bank. But ING has a large buffer of excess capital (more than 20% of its market capitalisation) that it intends to return to shareholders in the next few years.

Combined with a dividend yield of more than 7%,15 ING could potentially deliver an annual total return in the mid-teens, according to our analysis.

It’s important to note that European banks (in terms of their earnings) are yet to benefit from recent and expected rate rises in the region. Their latest quarterly results were in a period when the ECB’s benchmark deposit rate was still negative.

Valuations appeal

Current valuations suggest the market is more concerned about the risk of European recession than an ongoing recovery in bank earnings and dividends.

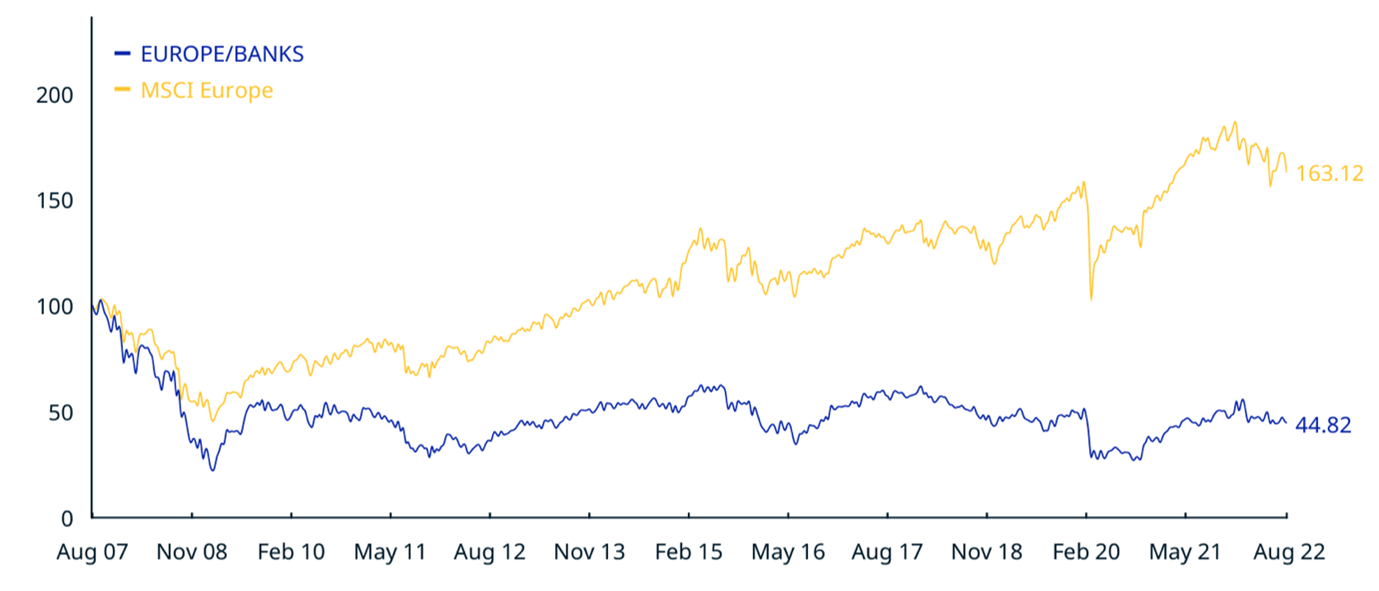

Chart 2 below show the large underperformance of European bank stocks relative to European equities. The gap has started to narrow over the past 12 months.16

Chart 2: Cumulative Index Performance (net returns EUR)

Source: MSCI. At 13 September 2022. Compares MSCI European Banks Index (EUR) in blue line, to MSCI European Index (yellow line).

The MSCI Europe Banks Index (EUR), a barometer of 26 bank stocks across Europe, trades on an average forward Price Earnings (PE) ratio of 6.48 times and a Price-To-Book (P/B) ratio of 0.61.17 That compares to average PE of 11.36 times and P/B of 1.77 for European equities.18

Simply, European banks are at a massive discount to European equities.

The market’s pessimistic view on European banks has two shortcomings. First, investors are focused on current macroeconomic gloom about Europe when the market always looks ahead. Second, valuations are already factoring in a recession in Europe.

Assuming the ECB lifts its benchmark deposit rate to around 2% by early 2023, the forward Price Earnings (PE) multiple for European banks in the PM Capital Global Companies Fund will fall to 4-5 times (from 7-8 times now).

For context, the Commonwealth Bank of Australia (CBA) trades on a forward PE of about 16 times19. In the US, Wells Fargo & Company20 and Bank of America both trade on a forward PE of about 9 times.21

In PM Capital’s view, it makes no sense that high-quality European banks, which are leaders in their respective market, could trade on a PE so far below that for CBA22 (assuming European interest rates rise to around 2% next year.)

European banks well provisioned

Clearly, investors are pricing in a severe, prolonged recession in Europe – and a sharp increase in bad and doubtful debts for European banks.

That view looks overdone. During COVID-19, European banks followed the global trend with heavy provisioning for bad debts. Loan losses during the pandemic were less than feared. In 2021, Europe bank began reversing their provisions, following US banks.

In its annual risk assessment of European banks, the European Banking Authority in December 2021 reported improvements in bank solvency, profitability and liquidity. It said fears about potential asset-quality deterioration had mostly not materialised.23

Compared to previous recessions, European banks are collectively better capitalised and have stronger balance sheets. Their loans books have relatively less risk. Tighter regulation and higher lending standards have bolstered the sector.

The best indication comes from European banks this year lifting dividends and continuing with their share buybacks. That suggests boards of European banks are more comfortable with their organisation’s capital position and ability to withstand a Eurozone recession.

In PM Capital’s view, European banks would not return excess capital if they expected a large spike in bad debts. All European banks in the PM Capital Global Companies Fund have a buyback program in place. We expect higher dividend yields across the European banking sector in FY23 as banks generally pay out about half of their earnings.

Moreover, the market continues to underestimate the benefits of consolidation in the European banking sector. Ireland’s banking sector now has three main players, from five, after consolidation.

In Spain, CaixaBank merged with Bankia last year, creating that country’s largest domestic bank. Industry consolidation will improve European banking scale and profitability – and reflects low valuations in the sector.

Conclusion

PM Capital’s investment in European banks illustrates our style to buy quality assets when they trade at bottom-quartile valuations. Often, this means buying stocks in deeply out-of-favour sectors when the market ignores value.

Our aim is to sell these assets when they achieve top-quartile valuations. Sometimes, this takes a full investment cycle of 7-10 years. The conviction to buy unloved assets – and the patience to wait until that value is realised – are hallmarks of our approach.

We believe European banks are in the early stage of a recovery that could take a decade to play out fully. We expect a gradual recovery in European bank earnings and are positioned to earn a potentially attractive dividend yield as that recovery unfolds.

Nobody can correctly predict the short-term outlook for Europe’s economy or the pace of Europe’s banking recovery. There are many risks given geopolitical, environmental and economic challenges in the Eurozone. Energy security is a growing issue.

We do know that value ultimately prevails. In years to come, 2022 will be viewed as an inflexion point for the European banks – and possibly the start of a decade-long recovery.

About the author

John Whelan is a Portfolio Manager at PM Capital, a leading asset manager of global and Australian equities and interest rate securities. John is Co-Portfolio Manager of the PM Capital Global Companies Fund and PM Capital Australian Companies Fund.

1At 31 August 2022

2At 31 August 2022

3See PM Capital report, “Five Investment Themes”. March 2022. www.pmcapital.com.au

4PM Capital (2022). “Brace for higher inflation”. 7 Feb 2022. www.pmcapital.com.au

5ibid

6UBS (2022), “European Banks”. Global Banking Research. 8 February 2022

7European Central Bank (2022). Monetary Policy Decisions. 8 September 2022

8European Central Bank. Survey of Professional Forecasters”. July 2022

9Based on comparison of 5.23% dividend yield from the MSCI Europea Bank Index compared to 3.36% yield for the MSCI Europe Index. Source: MSCI. At 31 August 2022.

10CaxiaBank’s Net Interest Margin rose by 2 basis points to 91 basis points in the second quarter of 2022, versus the first quarter 2022

11Lloyds Banking Group (2022). “2022 Half-Year Results: News Release” 27 July 2022. Page 1.

12Bank of Ireland (2022), “Interim Results for 2022 Presentation”. 3 August 2022.

13Bank of Ireland shares rose 22% over one month to 13 September 2022.

14ING Groep, (2022), “ING posts 2Q2022 net result of €1,178 million, supported by increased income and modest risk costs,”. 4 August 2022.

15At 13 September 2022

16Based on one-year returns to 31 August 2022 for MSCI Europe Banks Index versus MSCI Europe Index. Source: MSCI

17At 31 August 2022. Source MSCI Europe Banks Index (EUR) Fact Sheet.

18Ibid. European Equities refers to MSCI Europe Index

19Source Morningstar Inc. At 13 September 2022.

20Wells Fargo and Bank of America are both held in the PM Capital Global Companies Fund.

21At 13 September 2022

22At 13 September 2022

23European Banking Authority (2021), European Banking Risk Assessment,” 3 December 2021.

This insight is issued by PM Capital Limited ABN 69 083 644 731 AFSL 230222 as responsible entity for the PM Capital Global Companies Fund (ARSN 092 434 618) and the PM Capital Australian Companies Fund (ARSN 092 434 467), the "Funds". It contains summary information only to provide an insight into how we make our investment decisions. This information does not constitute advice or a recommendation, and is subject to change without notice. It does not take into account the objectives, financial situation or needs of any investor which should be considered before investing. Investors should consider the Target Market Determinations and the current Product Disclosure Statement (which are available from us), and obtain their own financial advice, prior to making an investment. The PDS explains how the Funds' Net Asset Value are calculated. Past performance is not a reliable guide to future performance and the capital and income of any investment may go down as well as up.