Global sports-betting giant positioned for rapid earnings growth in the US.

Key points

- Flutter Entertainment is a global sports-betting, online-gaming and online-poker business. Flutter operates in over 100 countries and is the market leader in the United Kingdom and Ireland, Australia and United States.

- The US is a lucrative growth market for Flutter. The US is estimated to be the world’s largest sports-betting market. However, this has historically been through the ‘grey market’ with regulated betting in its infancy in the US.

- Flutter is highly cash-generative due to its dominant positions in mature sports-betting markets, such as the UK and Australia.

- Flutter has competitive advantages through its market-leading technology platform, production innovation, customer-acquisition capabilities and scale. The business can grow beyond its core geographies into new markets.

- Flutter is trading 36% below its March 2021 high.1 Concerns about US competition and regulatory uncertainty in the UK have weighed on sports-betting and online-gaming stocks. But Flutter’s US growth and profitability could exceed market expectations over the medium to long term and be a catalyst to re-rate its share price, in PM Capital’s view.

By Kevin Bertoli, PM Capital

Many Australian sports fans would be familiar with advertisements for Sportsbet. Some might have used Sportsbet’s App to bet on horse racing or other sports.

Less understood is that Sportsbet is owned by Flutter Entertainment plc, a Dublin-based company that has its primary listing on the London Stock Exchange (LSE: FTLR).

PM Capital’s interest in Flutter emerged during our 2017 review of UK bookmaking sector, which included such companies as William Hill and Entain (at the time named GVC). PM Capital’s investment in global casino companies and our understanding of the local bookmaking industry added to our understanding of sports betting.

In 2017, investors largely ignored potential growth in US sports betting given its status as an unregulated ‘grey market’ outside of Nevada. PM Capital believed this market would become a significant, emerging opportunity. So, we watched and waited for value to emerge in sports-betting stocks with US exposure.

In April 2022, PM Capital initiated a position in Flutter for the PM Capital Global Companies Fund. The Fund’s initial entry point was around £82 a share.

We believed Flutter had traits of other PM Capital investments. Flutter has a strong position in a structurally growing market. The company’s leverage to the evolving legalised US sports-betting and online-gaming market could potentially provide years of growth. Importantly, at the time of PM Capital’s investment, Flutter traded at a material discount to our sum-of-the-parts valuation for it.

PM Capital’s investment style is to identify high-quality companies trading at bottom-quartile valuations. Often, this means buying deeply out-of-favour stocks and holding them through a full investment cycle (7-10 years) as we wait for value to be realised. Our goal is to sell when the company achieves a top-quartile valuation.

We believe Flutter can achieve this goal for five reasons:

1. Dominant position in a long-term growth market

In 2016, Flutter was created through the merger of Paddy Power and Betfair. In 2020, Flutter became the world’s largest online betting company with its US$6-billlion acquisition of The Stars Group, a Canadian gaming company.

Capitalised at £19.2 billion2, Flutter is a top-100 company on the London Stock Exchange.3 It began in 1988 as an Irish bookmaking business (through Paddy Power).

About half of Flutter’s revenue now comes from global sports betting via websites and Apps. Another 30% comes from online gaming and 15% from online poker.

By country, about 80% of Flutter’s revenue is earned in the UK and Ireland, Australia and the US. In the UK and Ireland, Flutter owns Sky Betting and Gaming, Paddy Power, Betfair and Tombola. It also has more than 600 Paddy Power betting shops.

In Australia, Flutter owns Sportsbet, the dominant player in our online sports-betting market with an estimated 50% market share. In 2009, Paddy Power acquired 51% of Sportsbet and bought the rest in 2011. Over the past decade, Flutter has built its business both organically through superior execution, and via M&A.

In the US, the crown jewel of Flutter’s operations is FanDuel. It also owns TVG, FOX Bet and PokerStars. They offer a mix of regulated real-money and free-to-play sports betting, online gaming, daily fantasy sports and online racing wagering products.

Flutter is well placed to capitalise in a long-term growth industry. The business has global reach, scaled investment in product innovation and technology, and strong local brands. The global sports-betting market is forecast to be worth US$140 billion by 2028, based on compound annual growth of 10.1% from 2021 to 2028.4

Much of this growth is occurring in online sports betting. Online gambling, mostly on football codes and horse racing, continues to take market share from physical betting (through betting shops).

The COVID-19 pandemic has quickened the shift to online betting. Younger people are likelier to place a bet via their smartphone than through a paper bet-slip at the local betting shop. Growth in mobile devices, advanced betting Apps and streaming services for live sport have fuelled growth in online sports betting. An increase in sporting leagues and high-profile sporting events is also driving growth in betting.

But sports betting and online gaming remain fragmented. Flutter has room to grow its market share in the UK (31%), the US (31%) and, to a lesser extent, Australia (50%).5

In dollar terms, Flutter did £10.5 billion of total sportsbook wagers in the UK in FY21; £11.7 billion in Australia; and £11.3 billion in the US.

It’s worth nothing that Flutter’s US division is generating similar sportsbook wagers to the UK and Australia, despite legalised sports-betting still in its infancy in the US.

Moreover, the US population is five times that of the UK and 13 times larger than Australia’s. That suggests Flutter’s US business can become significantly larger than its other key geographies, over time.

PM Capital believes Flutter is well placed to grow organically and through acquisitions as it drives industry consolidation. We expect future Flutter acquisitions will be smaller and more about buying brands in adjacent markets or geographies.

2. Flutter capitalising on US growth

The US sports-betting market is the key to Flutter’s long-term growth as more US States allow legalised online sports betting.

Betting on football and other sports in the US was historically done through local “grey markets” or offshore websites. For years, The Professional and Amateur Sports Protection Act (PASPA) effectively outlawed sports betting (except for a few US States).

In 2018, the US Supreme Court repealed PASPA, declaring it unconstitutional given Congress is not authorised to direct a state's regulation of its citizens. That enabled US States to introduce legislation that permitted sports betting. The decision was the result of a long-running attempt by the State of New Jersey to legalise sports betting in Atlantic City.

About 30 US States have since legalised sports betting, including 18 that allow online sports wagering.6 But the pace of legislative change has been ad-hoc across US States and sports-betting rules vary in terms of licence eligibility, duration and tax rates.

Also, several large US States, such as Texas, California and Florida, are yet to legalise sports betting. Some States might not legalise sports betting (others, such as Florida, could have their plans challenged in court). But up to three-quarters of the US population could have access to regulated sports betting by the end of 2022.

PM Capital believes that giving US states the authority over any decision to regulate and determine the scope of sports betting within their jurisdiction, supports incumbent providers, such as Flutter. Any new entrant looking to build out a footprint across the US must go through the process of applying for a separate licence in each state.

Flutter’s key US brand is FanDuel. In 2018, Flutter acquired a 58% stake in FanDuel, a US business that ran online fantasy sports-based games. In late 2020, Flutter increased its stake in FanDuel to 95%. Flutter said the 2020 transaction implied that FanDuel had an enterprise value of US$11.2 billion.

FanDuel’s true value is its large base of incumbent fantasy sports players (who compete to pick sports teams). This provides a ready-made database of mostly younger men (aged 20-50) for FanDuel to market legalised sports-betting products.

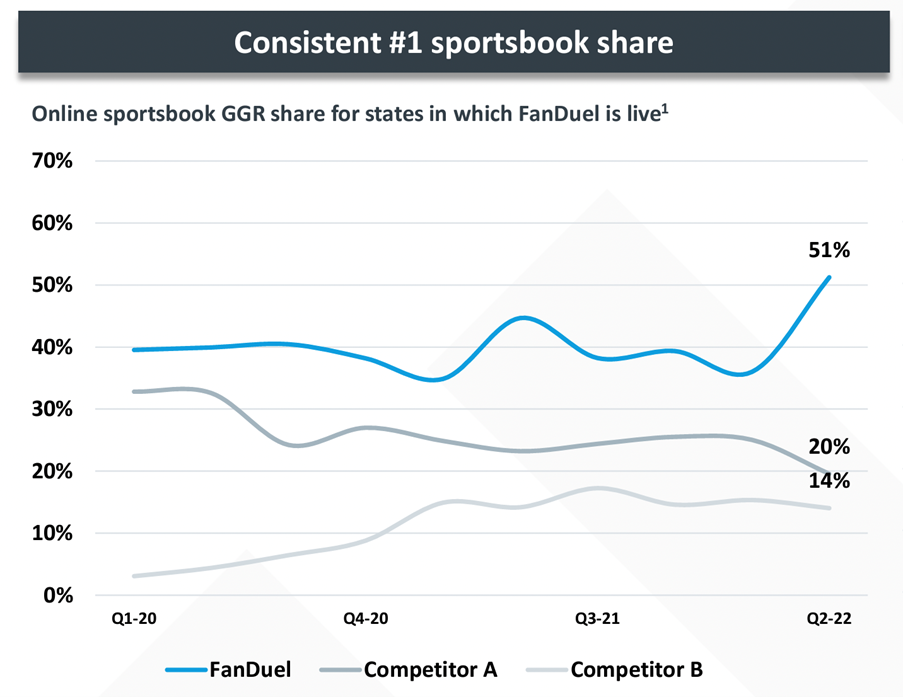

FanDuel is now the clear leader in US sports betting in states where it has a presence. In US states where FanDuel is live, the business had a 51% market share in the second quarter of 2022.7 FanDuel’s nearest competitor had a 20% share and the third player had a 14% share.8 FanDuel appears to have taken share from competitors this year (see Chart 1, below).

FanDuel’s revenues are growing much faster than its costs. The product has had 536% revenue growth since the first half of 2019 as it is rolled out across more US States.9 FanDuel’s operating costs have grown 252% in that period.10

Flutter’s US business was profitable during the second quarter of 2022.11 Flutter said the US business remains “firmly on track to be EBITDA positive for the full year 2023”. As FanDuel expands, Flutter’s US business is swinging from large losses to profits – and providing a third growth engine for Flutter.

Chart 1: FanDuel is the clear number-one operator in US sports betting

Source: Flutter Interim Results FY22. 1GGR market share of FanDuel and FOXBet in the states in which FnaDuel was live based on published gaming regulator reports in those states. Competitor estimates based on third party regulator reporting and Eilers and Krejcik reports. NGR market share includes AZ, PA and MI only.

3. Flutter’s mature businesses are highly cash-generative

In FY21, Flutter’s legacy UK and Ireland business was its most profitable division with an adjusted EBITDA of £616 million.12

But revenue from the UK and Ireland business declined 4% for the first half of FY22 compared to the same half in FY21.13 Revenue moderated towards pre-COVID-19 levels (more people gambled online during the pandemic). High inflation and rising living costs in the UK have also affected gaming volumes, although we expect this will be a short-term issue.

Furthermore, Flutter introduced safer gambling actions in advance of the delayed UK Gambling Act Review White Paper. Regulatory uncertainty is a headwind for Flutter’s UK operations, but the business has taken steps to support more sustainable growth in the UK, which we view as positive.

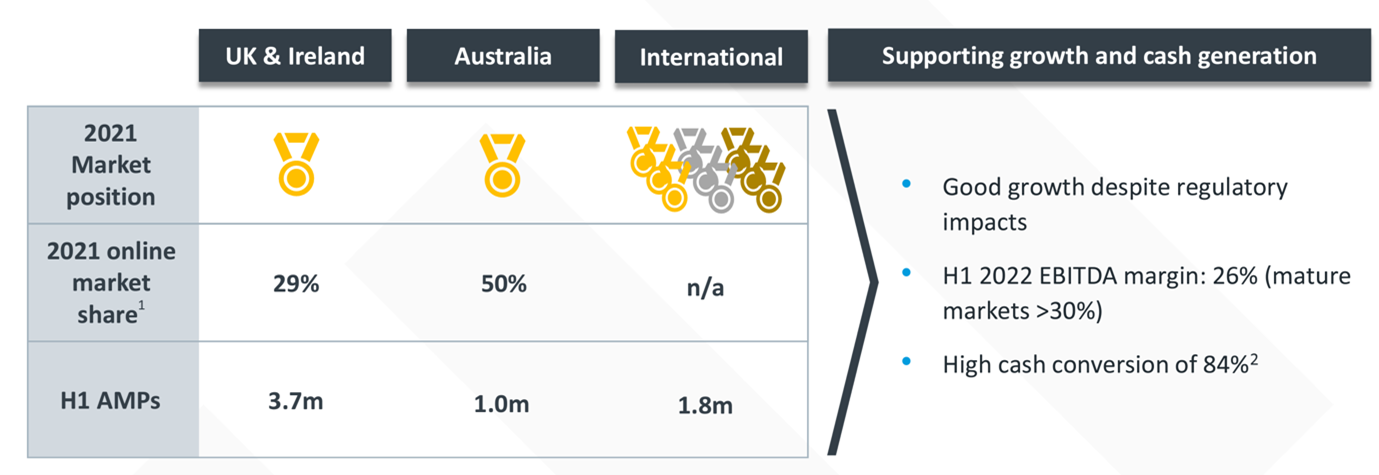

In Australia, Flutter continues to grow Sportsbet. The Australian division is Flutter’s second-largest by earnings. It delivered adjusted EBITDA of £411 million in FY21.14

Customer-retention initiatives for betting on National Rugby League (NRL) and Australian Football League (AFL) games drove 10% growth in Flutter’s average monthly players (AMPs) in Australia in the first half of FY22, year on year. Flutter has about 1 million AMPs in this market.15

However, Australia is a relatively mature market given Sportsbet already has 50% market share (followed by Tabcorp at an estimated 15-20%) and Entain (which owns Ladbrokes and Neds.com.au at an estimated 15% share). With the top-three players controlling up to 85% of this market, there is less scope for acquisitions and industry consolidation.

The flipside of industry consolidation (in Australia and the UK) is it improves the structure of sports-betting markets. There are fewer significant rivals and sources of irrational competition.

Flutter’s opportunity in Australia is to expand its EBITDA margin over time as its customer numbers grow and its marketing spend declines.

The Australian operation’s greater relative exposure to horse racing compared to other markets is an advantage as horse racing is historically a higher-margin sports-betting product. The main risk is higher State taxes levied on online sports betting and how Flutter would respond, given its limited prospects for market-share growth in Australia.

Clearly, Flutter’s UK, Ireland and Australian operations have lower growth prospects than its US operations, given that legalised betting in that market has only scratched the surface. But the UK and Australian businesses are highly cash-generative, meaning Flutter can internally fund its US growth ambitions.

Chart 2: Flutter’s operations (ex-US) are well positioned

Source: Flutter Interim Results FY22. 1Total NGR online market share in the UK and Ireland based on internal estimates. Total NGR online market share on Sportsbet based on competitor reporting and internal estimates. 2Cash conversion reflects conversion of adjusted operating profit to pre-tac adjusted free cash flow in H1 2022.

4. Sustainable competitive advantages/international markets

This analysis has so far outlined Flutter’s dominant position in long-term growth markets in sports betting and online-gaming, notably the US. The key, however, is for Flutter to exploit and maintain that opportunity through its competitive advantages.

PM Capital believes Flutter’s advantage stems from four main sources. First, Flutter has a market-leading technology platform. It continues to invest heavily in technology in sports betting, online gaming and online poker. Flutter’s proprietary global betting platform is the key to it entering new markets, adapting to local conditions and managing gaming and regulatory risks.

Product innovation is the second source of Flutter’s advantage. The company has a history of innovation in product offerings and odds-setting. Technology for multi-betting, for example, has enabled punters to place bets (through a “multi”) across a combination of sports and competitions.

Flutter’s third advantage is customer-acquisition costs. As it grows, Flutter is able to acquire more customers at lower cost and drive higher retention rates. In turn, lower marketing costs aid Flutter’s margin expansion in mature gaming markets. In the US, Flutter’s customer acquisition costs relative to peers also benefits from its legacy position in fantasy sports.

The fourth advantage is Flutter’s scale and ecosystem. At its FY22 interim result, Flutter said its “strong cash-generation profile allows us to allocate resources to power the ‘flywheel’ at a local market level.” Simply, Flutter has the size and relationships with key stakeholders (such as Sky Plc in the UK) to grow quickly in markets it enters.

Flutter wants to consolidate its market position in Italy, Georgia, Armenia and Spain. Italy now accounts for half of Flutter’s International division earnings following its 2021 acquisition of Sisal, a leading Italian gaming and lottery operator.

Canada, Brazil and India are other long-term growth opportunities Flutter has identified. If Flutter uses a similar playbook with its market-entry strategies, it will use its balance sheet to acquire local competitors and quickly develop scale.

5. Valuation/re-rating catalysts

Flutter rallied from £57 during the COVID-19 market sell-off in March 2020 to a high of almost £170 in March 2021. Sports-betting stocks soared last year as betting demand rose during COVID-19 and as the market focused on the prospects for US growth.

Chart 3: Flutter Entertainment plc (LSX)

Source: Factset, PM Capital

However, the rally in global sports-betting stocks turned into a rout over the past 12 months. Irrational competition in the emerging US sports-betting market and the UK Whitepaper (which stoked regulatory uncertainty) weighed on market sentiment.

The broader decline in global equities and unprofitable Total Addressable Market (TAM) stocks in 2022 exacerbated the sell-off in sports-betting companies.

PM Capital took advantage of these price falls, initiating a position at around £82 in April 2022.

At the time, Flutter traded at a 45% discount to PM Capital’s conservative sum-of-parts valuation for the company. FanDuel alone now constitutes a significant proportion of Flutter’s market capitalisation.

PM Capital believes Flutter will grow faster in the US than investors expect – and that the company’s US profitability will exceed market expectations in the next few years. That will be the catalyst for a re-rerating of Flutter that could play out this decade.

Flutter has also considered an Initial Public Offering (IPO) of FanDuel. Media reports suggest an IPO is unlikely in the short term, but a spin-out and listing of FanDuel as a standalone company in the next few years could act as a significant catalyst for Flutter shareholders. As long-term shareholders, PM Capital would prefer that Flutter maintains its ownership in FanDuel, given our view on its earnings upside.

Conclusion

Flutter now trades at £107 after its release of encouraging interim results for 2022. The results further confirm PM Capital’s assessment of Flutter’s US growth potential.

We acknowledge there are risks to Flutter’s growth trajectory. Online sports betting is highly competitive. When a new market opens like the US, barriers to entry are low (barriers to success, however, are high).

Regulation/tax change in the sector adds uncertainty. Another issue is whether consumers in mature sports-betting markets can continue to allocate as much of their income to sports betting as the global economy slows.

However, more than 90% of Flutter’s revenue now comes from regulated gaming markets. As the industry leader, Flutter is better placed to adhere to gaming reforms and safer betting practices – and contribute to the development of industry standards.

We also acknowledge that Flutter and online sports-betting companies could receive less support from institutional investors that use Environmental, Social and Governance (ESG) filters in stock selection. Ethical funds typically avoid gambling stocks.

For all the challenges, online sports betting, online gaming and online poker have years of growth ahead, particularly in the US. Our research suggests Flutter is best positioned to exploit that opportunity and remains undervalued at its current price.16

About the author

Kevin Bertoli is the co-Portfolio Manager of the PM Capital Global Companies Fund and PM Capital Australian Companies Fund. PM Capital is a leading asset manager in Australian and global equities, and interest rate securities.

1Flutter Entertainment plc shares traded at £169.1 on 22 March 2021 on the London Stock Exchange. Flutter traded at £108.8 on 19 October 2022.

2Flutter market capitalisation at 19 October 2022.

3Flutter was a constituent of the FTSE 100 index at 30 September 2022.

4Source: GrandView Research. Forecast at 19 October 2021.

5Market shares at 1 March 2022. Source: Flutter Entertainment Plc Preliminary Results 2021.

6Forbes magazine. “Where is Sports Betting Legal. A guide to all 50 US States.”. 7 Jan 2022.

7Source: Flutter Entertainment Plc Interim Results 2022.

8Ibid

9Ibid

10Ibid

11Ibid

12Flutter Entertainment plc – Preliminary Results 2021.

13Flutter Entertainment Plc Interim Results 2022.

14Flutter Entertainment plc – Preliminary Results 2021.

15Flutter’s average monthly players (AMP) in Australia in the first half of FY22 was 993,000. Source. Flutter Entertainment Plc Interim Results 2022.

16At 19 October 2022.

This Insight is issued by PM Capital Limited ABN 69 083 644 731 AFSL 230222 as responsible entity for the PM Capital Global Companies Fund (ARSN 092 434 618) and the PM Capital Australian Companies Fund (ARSN 092 434 467), the "Funds". It contains summary information only to provide an insight into how we make our investment decisions. This information does not constitute advice or a recommendation, and is subject to change without notice. It does not take into account the objectives, financial situation or needs of any investor which should be considered before investing. Investors should consider the Target Market Determinations and the current Product Disclosure Statement (which are available from us), and obtain their own financial advice, prior to making an investment. The PDS explains how the Funds' Net Asset Value are calculated. Past performance is not a reliable guide to future performance and the capital and income of any investment may go down as well as up.