'Fixed Income - Near-zero exposure to interest-rate risk' is one of five of PM Capital's current key investment themes

By Jarod Dawson, Portfolio Manager - Enhanced Yield Fund

Introduction

When assessing fund performance, it is not enough to analyse a fund’s positive returns during good months for markets – after all, a rising tide lifts all ships. As important is understanding how the fund performed during bad months and its ability to preserve investor capital.

Consider the PM Capital Enhanced Yield Fund, an award-winning1 fixed income fund that invests in local and global bond-market opportunities. The Fund aims to provide an attractive return above the Reserve Bank of Australia (RBA) cash rate, with low volatility and minimal risk of capital loss.

In February 2021, volatility in fixed-income markets spiked. Signs of global economic recovery fuelled fears of higher inflation and interest rates. The Australia 10-year Government Bond yield leapt around 0.75% that month.

Many income funds with high fixed-rate exposure underperformed significantly that month. In contrast, the PM Capital Enhanced Yield Fund returned 0.11% in February 2021, or 0.10% above the RBA cash rate.2 The Fund’s low exposure to interest-rate risk preserved capital.

October 2021 was another bad month for fixed-income markets. As market expectations for higher inflation grew, the Australia 10-year Government Bond yield rose 0.5% that month. That equated to a fall of around 5% in the 10-year bond’s value.

The PM Capital Enhanced Yield Fund returned -0.28% in October 2021. Again, the Fund’s near-zero interest-rate risk minimised losses and preserved capital.

Interest-rate market volatility has continued this year. In January 2022, fears that central banks had underestimated inflation strengthened expectations of faster rate rises. The Australia 10-year Government Bond yield rose around 0.25% that month.

As bond yields in Australia and the US spiked, the PM Capital Enhanced Yield Fund returned -0.02% in January 2022 due to its near-zero interest-rate exposure.

We highlight these returns for two reasons. First, to demonstrate the PM Capital Enhanced Yield Fund’s ability to outperform in different market conditions. Over one year3, the Fund outperformed the RBA cash rate by 1.2%. Over three and five years, the Fund outperformed its benchmark by 1.5% and 1.7% respectively.4

Second, the Fund’s performance during February 2021, October 2021 and January 2022 demonstrates how it continues to derive its returns with minimal volatility and low risk of capital loss.

Inflation view underpins Fund strategy

For the past year, PM Capital has argued that inflation would be more persistent than realised and disputed the view that an inflation spike was solely a temporary result of COVID-19-induced supply-chain bottlenecks. This view is reflected in PM Capital’s equities funds and in the PM Capital Enhanced Yield Fund.

Sharply higher inflation data this year confirms our view. In January 2022, the US inflation rate accelerated to 7.5%, the highest in 40 years. Australia’s Consumer Price Index rose 1.3% in the December 2021 quarter, bringing annual inflation to 3.5%.

Markets expect central banks will have to lift rates sooner and more aggressively than previously communicated, to cool economic growth and dampen inflation.

Goldman Sachs, a US investment bank, believes the US Fed will hike rates seven times in 2022 – for a combined 1.75%.5 UBS expects European interest rates to increase by 1.5% by 2024.6

In Australia, Westpac expects the RBA to start raising interest rates as early as August this year – and for the cash rate to reach 1.75% by March 2024 (from 0.1% now).7 Like other developed nations, Australia is on the cusp of a rate-raising cycle.

The Bank of England (BOE) has already begun raising rates to combat soaring inflation. In February 2022, the BOE raised rates for the second time in three months.

Higher interest rates do not surprise PM Capital. Our investment approach is based on understanding where assets are in a cycle. We seek to buy assets at bottom-quartile valuations and sell at top-quartile valuations. We also look for signs of irrational market sentiment.

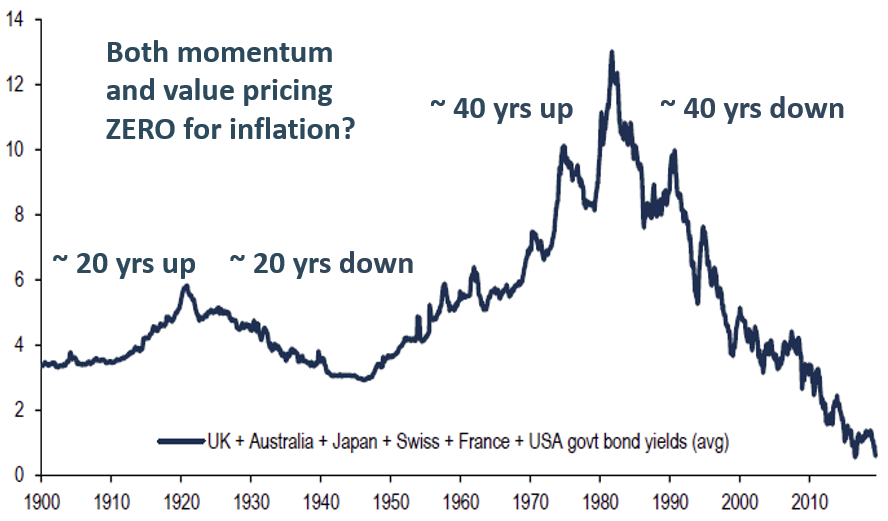

That was true of global bond yields last year. In our view, too many investors had forgotten what a normalised rate should look like. After 40 years of falling government bond yields (see chart below), some investors assumed near-zero rates were the norm. They did not realise that negative rates in some European countries signalled the end of a 40-year bull run for the bond market.

Chart 1: Global Government Bond Yields

Source: PM Capital

Our long experience from investing through several bond market cycles reminded us that government bond yields were abnormally low. We positioned the Fund for the prospect of high rates by cutting exposure to fixed-rate bonds and increasing exposure to floating-rate bonds that benefit as yields rise.

Current Fund positioning

The PM Capital Enhanced Yield Fund retains a highly defensive position. About half of the Fund is invested in cash and short-dated yield investments.

We believe this strategy will help protect investor capital if volatility in bond markets increases over the next six to 12 months. The strategy also provides Fund liquidity to capitalise on mispriced corporate bonds during a period of high volatility.

We continue to believe some central banks worldwide are ‘behind the curve’. That is, they are not raising interest rates fast enough to keep up with inflation and growth. If inflation rises too far, central banks will have to raise rates sooner and in larger increments. If this happens, volatility in equities, corporate bonds, real estate and other risk assets will increase.

The ability to preserve capital – a central tenet of successful long-term investing – could come to the fore in 2022. That is a key focus of the PM Capital Enhanced Yield Fund and our performance during volatile months for bond markets reinforces our strategy.

| Back to our 5 current themes | Managed Funds | Contact Us | Subscribe to our insights |

Notes and references

1The PM Capital's Enhanced Yield Fund was awarded the Money magazine Best of the Best Awards 2020: Best Income Fund – High Yield and Credit.

2The RBA Cash Rate. Returns at 31 January 2021.

3Returns to 31 January 2022.

4Ibid.

5Curran, E (2022), “Goldman sees Fed hiking seven times in 2022 instead of five,” Bloomberg. 11 February 2022.

6UBS (2022), “European Banks”. Global Banking Research. 8 February 2022.

7ABC News, (2022), “Westpac Forecasts RBA Rate Rise by August … “30 January 2022.

This Insight is issued by PM Capital Limited ABN 69 083 644 731 AFSL 230222 as responsible entity for the PM Capital Enhanced Yield Fund (ARSN 099 581 558, the ‘Fund’). It contains summary information only to provide an insight into how we make our investment decisions. This information does not constitute advice or a recommendation, and is subject to change without notice. It does not take into account the objectives, financial situation or needs of any investor which should be considered before investing. Investors should consider the Target Market Determinations and the current Product Disclosure Statement (which are available from us), and obtain their own financial advice, prior to making an investment. The PDS explains how the Fund’s Net Asset Value is calculated. Past performance is not a reliable guide to future performance and the capital and income of any investment may go down as well as up.

See www.pmcapital.com.au/enhanced-yield-fund/performance for standard reporting periods. The investment objective is not a forecast, and is only an indication of what the investment strategy aims to achieve over the medium to long term. Returns are calculated from exit price to exit price assuming the reinvestment of distributions for the period as stated and represent the combined income and capital return. The Index is RBA Cash Rate. See www.rba.gov.au for further information.