'Greenshoots for Irish home builders' is one of five of PM Capital's current key investment themes

By John Whelan, Co-Portfolio Manager - Equities

Introduction

PM Capital has a history of investing in the epicentre of crises. Our search for value sometimes takes us to the most-affected companies in the worst-hit sectors.

That was true of our initial investment in European commercial real estate companies in 2014 and our rotation to European residential builders over 2015 to 2018.

Parts of the European property market collapsed after the 2008-09 Global Financial Crisis. Several European countries entered recession; demand for office, industrial and retail property stalled; and banks curtailed lending to property companies and individuals.

PM Capital took advantage of sharply lower valuations in European commercial property companies through an initial investment in Hibernia REIT, an Irish Real Estate Investment Trust that invests in offices. We also initiated a position in Hispania, a Spanish REIT that invested in hotels (Blackstone acquired Hispania in 2018).

Both stocks performed well following the recovery in the underlying market, prompting PM Capital to realise gains and move into European residential builders a few years later. We expected the European property recovery to begin with commercial property then work its way to the residential market, in a cycle that would take up to a decade to play out.

In 2016, the United Kingdom’s decision via a referendum to withdraw from the European Union injected further uncertainty into European property markets.

At the time, land and property prices in Ireland had collapsed. Residential property transactions were sharply lower. A speculative property bubble in Ireland that began in the early 2000s had burst. Residential property stocks were badly out of favour.

PM Capital visited Ireland to understand why property prices had fallen 60% or more in some areas, in addition to homes sales falling over 80%. We wanted to know why more people were not buying Irish residential property at much lower prices, and to gauge the sector’s recovery prospects. We asked ourselves: “What would happen if Sydney home prices fell 60% peak-to-trough?”

In 2015, PM Capital invested in Cairn Homes, a designer and builder of new homes in Ireland and owner of a large land bank. Later, we invested in Glenveagh Properties, another Irish home builder that has similar investment characteristics to Cairn.

Beneath the short-term gloom, PM Capital had a positive view on Europe’s long-term recovery prospects and particularly those of Ireland, a growth engine in the region. Our investment thesis was that economic recovery in Ireland would drive jobs growth, which in turn would bolster demand for new home-and-land packages.

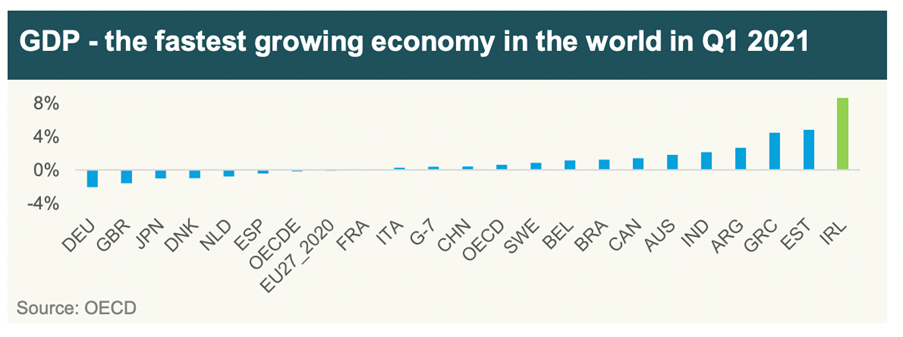

That view proved correct. In 2021, Ireland had the fastest-growing economy in the eurozone.1 In January 2022, the Central Bank of Ireland said it expected the Irish economy to grow by 8.7% this year and 5% next year on the back of strong domestic demand and a COVID-19 recovery.2

Chart 1: Irish economy booms

Source: Glenveagh Properties' H1 FY21 results presentation.

Ireland’s strong macro-economic backdrop is translating into rising housing construction. New housing starts exceeded 30,000 last year – the highest since 2008.3 That is a big tailwind for Cairn Homes and Glenveagh Properties.

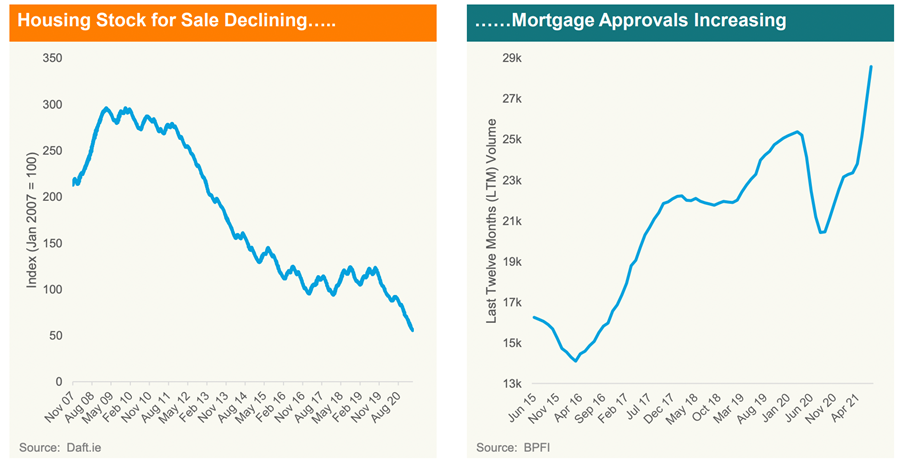

Chart 2: Mismatch between Irish home supply and demand

Source: Glenveagh Properties' H1 FY21 results presentation.

Although new housing starts are increasing, we expect housing supply in Ireland will lag demand for several years. COVID-19 caused construction delays, exacerbating the housing supply/demand gap. At the same time, a sharply higher savings rate in Ireland during the pandemic has contributed to rising property demand.

Glenveagh believes Ireland will need upwards of 35,000 new homes built each year, or 400,000 in the next decade, to meet demand.4 The Irish Government’s new ‘Housing for All’ strategy to 2030 should further support housing demand.

Attractive fundamentals

Cairn Homes is well positioned. In 2015, Cairn invested in a large land bank. Unlike most property developers, Cairn bought the majority of its land bank early at a lower price, rather than buy land in parcels and pay higher prices as the recovery unfolds.

The result: Cairn has a 10-12-year land bank in an undersupplied Irish housing market where property prices are growing 5-10% annually. With no need to replenish its land bank, Cairn should generate 18-20% free cash flow margins, which we expect will be returned to shareholders through dividends and share buybacks. These higher margins should persist until Cairn’s land bank normalises in 2025.

Early signs are promising. Cairn shares have more than doubled from the March 2020 low but remain below 2018 levels. Some investment banks have upgraded their earnings forecasts and price targets for Cairn.

In March 2022, Cairn said it had its “strongest-ever performance” in terms of new home sales in 2021. Cairn upgraded its earnings guidance and said it will return capital to shareholders through special dividends and/or share buybacks.5

Like Cairn, Glenveagh Properties is performing strongly as residential property demand in Ireland outstrips supply.

Launched in 2017, Glenveagh Properties targets three key property segments: suburban, urban and partnerships (through joint ventures with local authorities that provide the land). The partnership model provides a higher return on equity for Glenveagh and enables it to use its building expertise without allocating large amounts of capital to buy land.

Also like Cairn, Glenveagh Properties has strong free cashflow generation and is returning capital to shareholders through an aggressive buyback program. Glenveagh has delivered positive recent trading updates amid rising construction volumes of new homes in Ireland and higher sales prices. Glenveagh’s share price also rallied last year.

Conclusion

PM Capital’s investment in European property companies shows the benefits of buying assets at bottom-quartile valuations when there is excessive negative sentiment.

Through a long-term, disciplined approach, we were prepared to wait for a recovery in European property, believing it would be strong when it arrived. Irish property, among the worst-affected markets, had some of the best recovery prospects.

Our rotation from commercial to residential property capitalised on cycles within a broader European property cycle. In hindsight, we invested in Irish residential builders slightly too early, but their results in the past two years vindicate our strategy.

| Back to our 5 current themes | Managed Funds | Contact Us | Subscribe to our insights |

Notes and References

1 Independent, (2021). “Irish economy growing at fastest rate in EU”. 7 September 2021.

2 The Irish Times (2022), “Irish Economy set to generate 167,000 jobs over next two years,” 26 January 2022.

3 Independent (2021), “Number of housing starts passes 30,000 as construction hits its fastest pace since 2008,” 29 October 2021.

4 Glenveagh Properties (2021). “2021 Interim Results,” 26 August 2021.

5 Cairn Homes. H1 FY21 Interim Results Presentation. Note FY21 now released.

This Insight is issued by PM Capital Limited ABN 69 083 644 731 AFSL 230222 as responsible entity for the PM Capital Global Companies Fund (ARSN 092 434 618, the ‘Fund’). It contains summary information only to provide an insight into how we make our investment decisions. This information does not constitute advice or a recommendation, and is subject to change without notice. It does not take into account the objectives, financial situation or needs of any investor which should be considered before investing. Investors should consider the Target Market Determinations and the current Product Disclosure Statement (which are available from us), and obtain their own financial advice, prior to making an investment. The PDS explains how the Fund’s Net Asset Value is calculated. Past performance is not a reliable guide to future performance and the capital and income of any investment may go down as well as up.

See www.pmcapital.com.au/global-companies-fund/performance for standard reporting periods. The investment objective is not a forecast, and is only an indication of what the investment strategy aims to achieve over the medium to long term. Returns are calculated from exit price to exit price assuming the reinvestment of distributions for the period as stated and represent the combined income and capital return. The Index is MSCI World Net Total Return Index (AUD). See www.msci.com for further information.