Enhanced Yield Fund – what a difference a year can make!

Author: Jarod Dawson

For some time now we have been saying to clients that we thought there was a real risk to investor capital by having a material exposure to long term interest rates. We were particularly vocal about this in our quarterly reports throughout 2021 and into 2022:

Mar 21 – “we think that holding long term interest rate risk in a fixed income portfolio is still fraught with danger, and that over the longer term, interest rates are likely to rise further – potentially significantly.”

Jun 21 – “We suspect that central banks – and in particular the RBA – will likely have to start raising interest rates sooner than what they are currently guiding to markets in order to keep up with economic momentum. In light of this, we are maintaining effectively zero interest exposure in the Fund.”

Sep 21 – “we think markets are underestimating the sustained inflationary impact of the recovery, and thus we expect long term bond yields to increase as a consequence of this dynamic.”

Dec 21 – “we think one of the biggest risks to fixed income investors over the next couple of years is an erosion of capital as a result of meaningfully higher bond yields”

Mar 22 – “Given the extreme impact of significant employment growth and COVID-19 household savings leading to substantial consumer demand, COVID-19 supply bottlenecks, and the war in Ukraine on the general level of global prices, we expect a significant increase in official interest rates over the next few years. This is likely not yet fully priced into markets.”

A great deal has transpired since March of this year. If we fast forward to today (3rd November) we can see that:

- The RBA Cash rate has gone from 0.10% to 2.85%

- The US Fed Funds Rate has risen from a range of 0.10%-0.25% to a range of 3.75%-4.00% and looks to be going materially higher.

- Australian government 3 year bonds have increased in yield from ~0.10% to ~3.50% (a capital loss of ~10%) and similarly Australia’s 10 year bonds have gone from ~1.75% to ~4% (a capital loss of ~20%)

- US government 3 year bonds have increased from a yield of 0.35% to ~4.5% (a capital loss of ~10%) and 10 year bonds have increased from ~1.75% to ~4% (a loss of ~20%)

Since early 2022, given the substantial increase in yields that we have witnessed, we believe the risk / reward equation is now far more in favour of the investor. Thus, we have been slowly and methodically building an exposure to fixed interest rates in the Enhanced Yield Fund - primarily in 1 to 2 year bonds – at yields mostly between 4% and 6%.

This includes both pure fixed interest investments and a meaningful investment in corporate bonds issued by companies that we believe have very dependable business models, that we believe can generate appropriate levels of earnings across a wide range of economic environments.

Some of the key businesses whose bonds we have purchased over the past 6 months or so are Woolworths, Coca Cola, McDonalds, Ampol, US banking giant Wells Fargo, Transurban Queensland (owner of major Queensland toll roads) and South Australia Power Networks (maintains the poles, wires and substations that deliver power to ~2m South Australians.)

Our thesis for being happy and even eager to lock in shorter dated fixed rate yields at this juncture is based in part upon the considerable leverage that has built up in the private sector in Australia – mostly within the housing market. Our analysis tells us that historically, the mortgage rates that the average household in Australia pays tends to range somewhere between 2-3% above the prevailing RBA Cash Rate.

Currently bond markets in Australia are pricing in a peak in the RBA cash rate of ~4% in 2023 (a long way from the current rate of 2.85%) – which in turn implies average mortgage rates of around 6-7% at that point.

Given the enormous leverage in the private sector in Australia (which is substantially made up of mortgage debt), and the very low borrowing rates that many loans have been taken out at over the past few years, we believe it is unlikely that households can sustain mortgage rates at these levels – and thus the RBA is unlikely to reach a 4%+ cash rate any time soon. Indeed, the RBA has recently indicated that it is reducing both the size and frequency of increases in the official cash rate, and we suspect that over the next 6 months they will have stopped increasing rates all together – at least for a period of time.

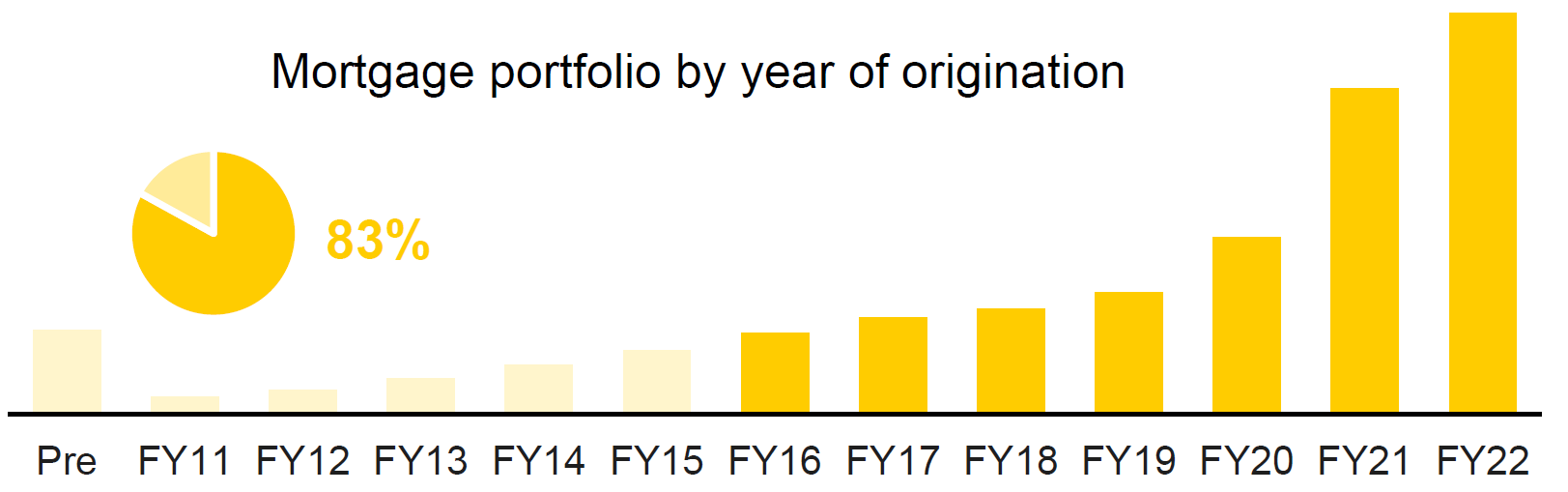

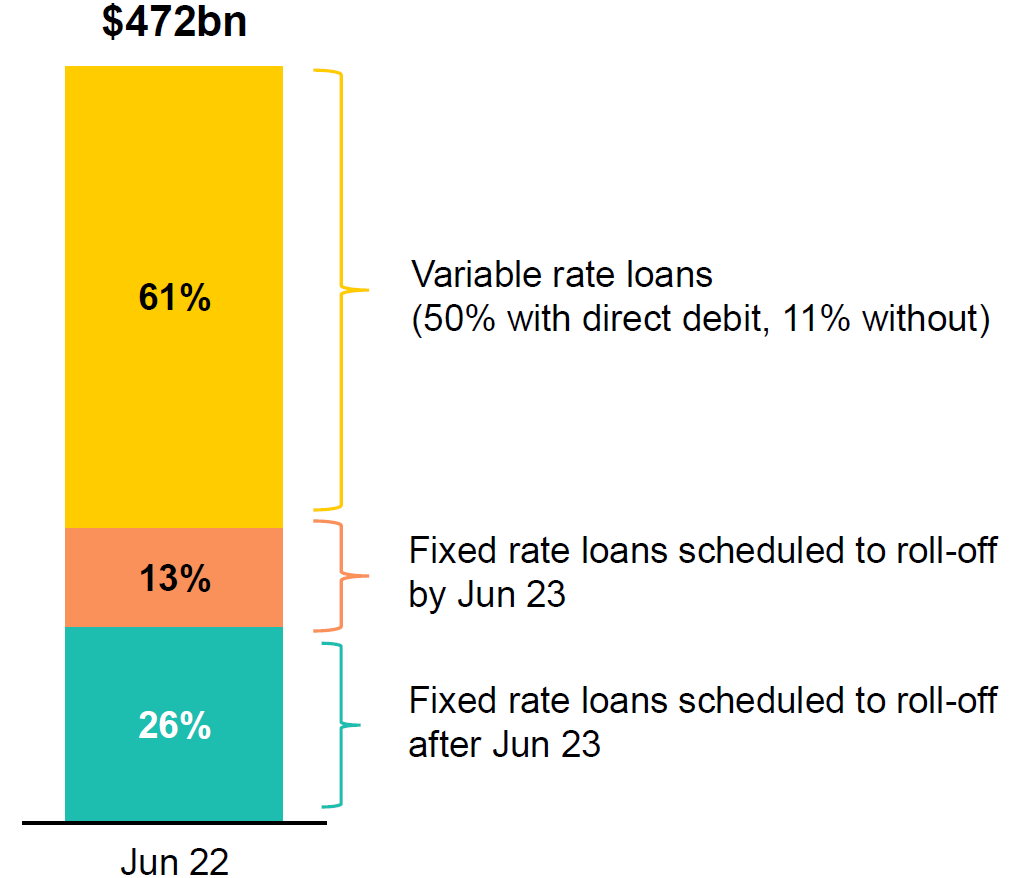

As you can see from the charts below – provided by CBA at a recent earnings update, a staggering ~50% of CBA’s loans (including refinancing) were written in FY21 and FY22. Furthermore ~75% of the loans are variable in nature, or at least revert to variable loans on or before June 2023. Assuming this holds true to some extent for the other major banks, then this suggests to us that mortgages in general are highly sensitive to the dramatic increase that we have seen in the official RBA cash rate - and corresponding mortgage rates in recent months. We expect that this will lead to considerable mortgage pressure near term, and to some extent limit the degree to which the RBA is able to increase official interest rates.

Source: June 2022 CBA earnings presentation

Furthermore, both borrowers and banks are reporting that households – by definition – are no longer able to borrow anywhere near what they could borrow 6-12 months ago – as a result of the higher interest rates being charged. This is another way of saying that all things being equal, existing borrowers are unlikely to be able to pay off the same quantum of loans that they have signed up to over the past couple of years. A matter of considerable concern for many households, we would now imagine!

The counter to this argument is that in recent years households have built up a large cash buffer against their mortgages, that can be drawn down upon. However, we believe this is fast being depleted. We also think that to some extent it is being masked by the fact that some banks are slow to adjust customers mortgage payments upwards – in some cases preferring to make changes to payments only a few times per year. Thus when they do adjust their customers mortgage payments, the buffers may not only be gone, but borrowers may well have fallen some distance behind on their loan schedules - and their loans may have increased also!

All in all, we think 6-7% mortgage rates – in some cases an effective tripling of mortgage rates from the lows of early 2022 - will be too much for many households to handle. Therefore we are happy locking in substantial yields in the current environment, on the expectation that markets will be disappointed by the degree to which the RBA is able to further increase official interest rates.

Our current investors, and those that follow the Enhanced Yield Fund closely, will know that despite the extraordinary losses that have been experienced in interest rate markets over the past year, the Enhanced Yield Fund has effectively preserved capital - with a 1 year return of -0.5%. This was achieved as a result of our conservative interest rate positioning going into the sharp rise in interest rates and bond yields in 2021 and 2022.

This is just the starting point though – a base for us to build on.

We have done a considerable amount of investing over the past 6 months or so, so much so that the yield to maturity on the Fund – ie the average yield across all the Fund’s investments - is now ~5.25%^ - a very large increase compared to 6 months ago – and materially above the current RBA cash rate of 2.85%.

Given the sharp moves higher in interest rates, we have been able to achieve this yield with almost no increase in the average term to maturity of our corporate bond investments, and only a modest amount of interest rate exposure (the average interest rate exposure of the fund is currently less than 1 year.)

With the Fund’s considerable history of taking advantage of major market disruptions (including the Global Financial Crisis, the European Debt Crisis, the China growth scare in 2015, the Trump and Brexit years, as well as the more recent COVID-19 pandemic, we are well credentialed when it comes to investing through periods of volatility.

The considerable patience that we have shown over the past couple of years in terms of our conservative interest rate positioning is paying off, and we are excited about the opportunities that are now being created. In light of this, we very much look forward to reporting on the outcomes of the substantial amount of investing that we have done in future reports.

PM Capital is a co-investor with clients in the Enhanced Yield Fund.

^ before fees

This insight is issued by PM Capital Limited ABN 69 083 644 731 AFSL 230222 as responsible entity for the PM Capital Enhanced Yield Fund (ARSN 099 581 558, the ‘Fund’). It contains summary information only to provide an insight into how we make our investment decisions. This information does not constitute advice or a recommendation, and is subject to change without notice. It does not take into account the objectives, financial situation or needs of any investor which should be considered before investing. Investors should consider the Target Market Determinations and the current Product Disclosure Statement (which are available from us), and obtain their own financial advice, prior to making an investment. The PDS explains how the Fund’s Net Asset Value is calculated. Past performance is not a reliable guide to future performance and the capital and income of any investment may go down as well as up.