3 Structural shifts to position for in New Financial Year

How to navigate the ‘Great Decoupling’ underway between the US and China.

A structural reset of the global economy is to likely continue over the next 12 months as the United States and China selectively ‘decouple’ from each other.

Trade decoupling is well underway as the US lifts tariffs to discourage Chinese imports and encourage US manufacturers to produce more goods domestically.

Technology decoupling is ongoing as the US attempts to disrupt China’s access to artificial intelligence, advanced semiconductors and other critical technologies.

Financial decoupling continues as more Chinese companies are forced to delist from US stock exchanges. US restrictions on US investment into sensitive industries, such as quantum computing in China, are another feature.

This ‘Great Decoupling’ goes both ways. China is decoupling from the US by reducing its reliance on the US dollar in global finance, decreasing its exposure to US debt1, investing in technology self-sufficiency and building new global alliances.

These are profound changes for the global economy. Just as the coupling of the US and Chinese economies took decades through globalisation, their decoupling may take decades through deglobalisation.

The implications for investors are threefold. First, the structural reset of the global economy is in its infancy. Although we expect this trend to continue in 2025-26, it has a long way to run. Investors may likely need at least a seven to 10-year horizon.

Second, many threats will accompany the global economy’s structural reset. Geopolitical and macroeconomic risks are likely to continue to rise this decade as global supply chains are reconfigured and new alliances formed.

Third, this uncertainty could fuel higher market volatility, creating potential opportunities for long-term investors to capitalise when assets are irrationally oversold.

The key is knowing which industries and companies will likely benefit most from the Great Decoupling and structural reset of the global economy – and buying them when undervalued.

More than ever, an active investment approach is needed. This is no time for overreliance on passive investment strategies through indexing. The big winners from the structural reset will likely be a narrow group of themes, sectors and companies. Here are three themes PM Capital favours:

1. Reshoring

The COVID-19 pandemic encouraged multinationals to increase manufacturing at or near home, to reduce global supply chain risks – a process of ‘reshoring’ or ‘near-shoring’.

Then came President Trump’s second term. Trump believes the world over-relies on Chinese manufacturing and must change. He wants more manufacturing to return to the US.

Trump is using the blunt instrument of tariffs to force this change. Right or wrong, higher US tariffs will accelerate global reshoring in manufacturing, as more companies lift production locally to avoid import tariffs.

Siemens, a PM Capital portfolio holding, is leveraged to this trend. Siemens is the global leader in factory automation and industrial technology.

Factory automation and digitisation are critical if manufacturing is to return to the US due to the cost of building new facilities there and shortage of trained labour in this sector. These are powerful trends for Siemens, which could benefit from rising demand for its industrial hardware and software.

2. European banks

The Great Decoupling could be a catalyst for Europe’s economic revival. As geopolitical risks rise, Germany, France and other European countries are stimulating their economies and plan to increase infrastructure and defence spending.

In March 2025, Germany announced a €500b fiscal package to finance infrastructure and clean-energy investments.2

Germany plans to raise its core defence spending from 2.4% of GDP to 3.5% by 20293. NATO countries will lift direct military spending to 3.5% of their GDP by 2035 in response to Trump’s demand for allies to do more on defence. Another 1.5% of GDP is required for defence-related spending, such as cybersecurity, further stimulating European growth.4

Germany also wants to make its economy more efficient by removing red-tape and exempting small and medium-sized enterprises from onerous EU regulations. Corporate tax cuts are another ambition.

In trade, higher US tariffs on Chinese imports could encourage Chinese manufacturers to pivot to Europe and other markets. Greater trade between China and Europe could follow, further aiding Europe’s economic revival.

European banks are the largest theme in PM Capital’s global strategy. Portfolio holdings such as Lloyds Banking Group in the UK, CaixaBank in Spain, ING Groep in The Netherlands and Bank of Ireland trade on significantly lower valuation multiples than their US and Australian peers.

A reviving European economy should stimulate European industrial activity, create jobs and boost anaemic credit growth, aiding banks there. Continued banking rationalisation in Spain and other European markets is another positive.

3. Commodity scarcity

Natural resources are increasingly being used as leverage in economic warfare – a trend adding artificial barriers to long-term commodity supply.

President Trump is using commodities as bargaining chips for trade concessions, diplomacy and international politics. This is evident in uranium, rare earths, copper, battery metals, steel, aluminium and other commodities.

China is also engaging in commodity warfare, having increased its investment in African resource projects as Western mining companies left Africa due to Environmental, Social and Governance (ESG) concerns. China now controls some of the world’s best undeveloped reserves in iron ore and copper in Africa.

Copper is prominent in commodity warfare. In February 2025, Trump issued an Executive Order, ‘Addressing the Threats to National Security from Imports of Copper’. He noted that a single foreign producer dominates global copper smelting and refining, controlling over 50% of global smelting capacity and holding four of the top five largest refining facilities. Also, that this copper dominance poses a direct threat to US national security and economic stability.

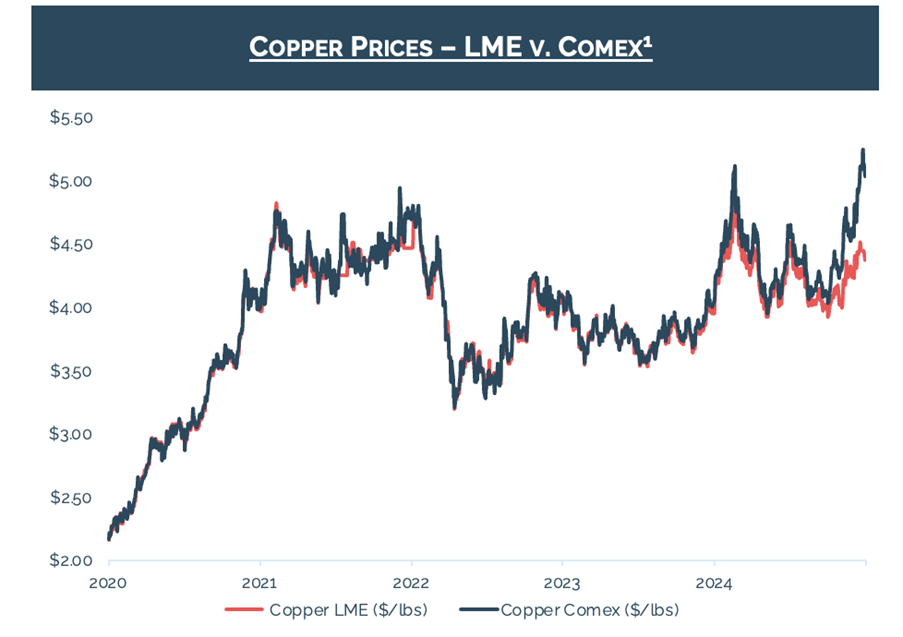

This shift is evident in copper markets, as shown in the chart below, with growing divergence between the London Metal Exchange and Chicago Comex copper prices (the two prices historically track each other). This widening gap is due to Trump’s proposed tariffs on copper imports as part of his plan to drive greater US commodity independence.

Source: FactSet

These artificial barriers to commodity supply coincide with decades of global underinvestment in new and existing resource projects, and with new drivers of commodity demand from the transition to renewables. Copper, for example, is a key commodity in electric vehicles and clean-energy infrastructure.

Copper has been a long-term theme in PM Capital’s global strategy, principally due to our expectation of growing supply constraints for this and other commodities.

Freeport McMoRan, a portfolio holding, is the world’s second-largest copper producer with strategic assets in the US. The company accounts for around half of copper production and 70% of copper refining capacity in the US, making it a direct beneficiary of favourable US government policy for domestic copper production.

Conclusion

Manufacturing reshoring, a European economic revival and commodity scarcity are potentially powerful themes for long-term investors in global equities in FY26 and beyond. The Great Decoupling of the US and China – and the structural reset that is causing for the global economy – are accelerating these themes.

For investors, the challenge is identifying the highest-quality companies exposed to these themes, buying them when they offer exceptional value, and knowing when to take profits. That requires a highly active approach in the context of a long-term framework grounded in discipline, patience, conviction and valuation – the hallmarks of PM Capital’s investment approach.

More information on PM Capital’s Global Companies Fund is available here.

1 US Department of Treasury, ‘US Long-Term Securities Held by Foreign Residents’. At April 2025.

2 ESG News, ‘Germany to Allocate €100B from €500B Fund to Climate, Energy Transition, 19 March 2025.

3 ABC News, ‘Germany to raise defense spending to 3.5% of GDP in 2029’, 24 June 2025.

4 Defense News, NATO allies agree to boost defense spending to 5% at The Hague summit. 26 June 2025.

Disclaimer:

This insight has been prepared by PM Capital Limited (ABN 69 083 644 731, AFSL No. 230222) as responsible entity and investment manager of the PM Capital Global Companies Fund (ARSN 092 434 618) (‘Fund’).

The information contained in this insight is for Fund investor use only. The views expressed herein are part of a wider fund investment strategy and should not be considered in isolation. It is general information only and is not intended to provide you with financial advice, and does not (and does not intend to) contain a recommendation or opinion which is intended to be investment advice or personal advice

The information has been prepared without taking into account your objectives, financial situation or need. You should consider the product disclosure statement (PDS) and the Target Market Determination which are available from us for free at www.pmcapital.com.au/steps-investing.

If you require financial advice that takes into account your personal objectives, financial situation or needs, you should consult your licensed or authorised financial adviser. This information is only as current as the date indicated, and may be superseded by subsequent market events or for other reasons. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information.

Certain statements in this presentation may constitute forward looking statements. Such forward looking statements involve known and unknown risks, uncertainties, assumptions and other important factors, many of which are beyond the control of the PM Capital and which may cause actual results, performance or achievements to differ materially (and adversely) from those expressed or implied by such statements.

Past performance is not a reliable indicator of future performance. All investments contain risk and may lose value, please refer to the PDS for more information.