Markets are moving

The last few years have seen a generational shift in bond markets. Interest rates, trending down for more than 30 years, neared zero in Australia and were low, or even negative in most of the developed world. Inflation was largely contained for years, while defaults were down and asset prices grew through most of the post-GFC recovery period.

These factors are reversing. We would argue that interest rates have entered a structurally higher period and sub-2% RBA rates were the outlier.

The resurgence of potential market volatility makes active bond management more important than ever. There is strong outright yield to be had but capital needs to be preserved.

Capital at risk

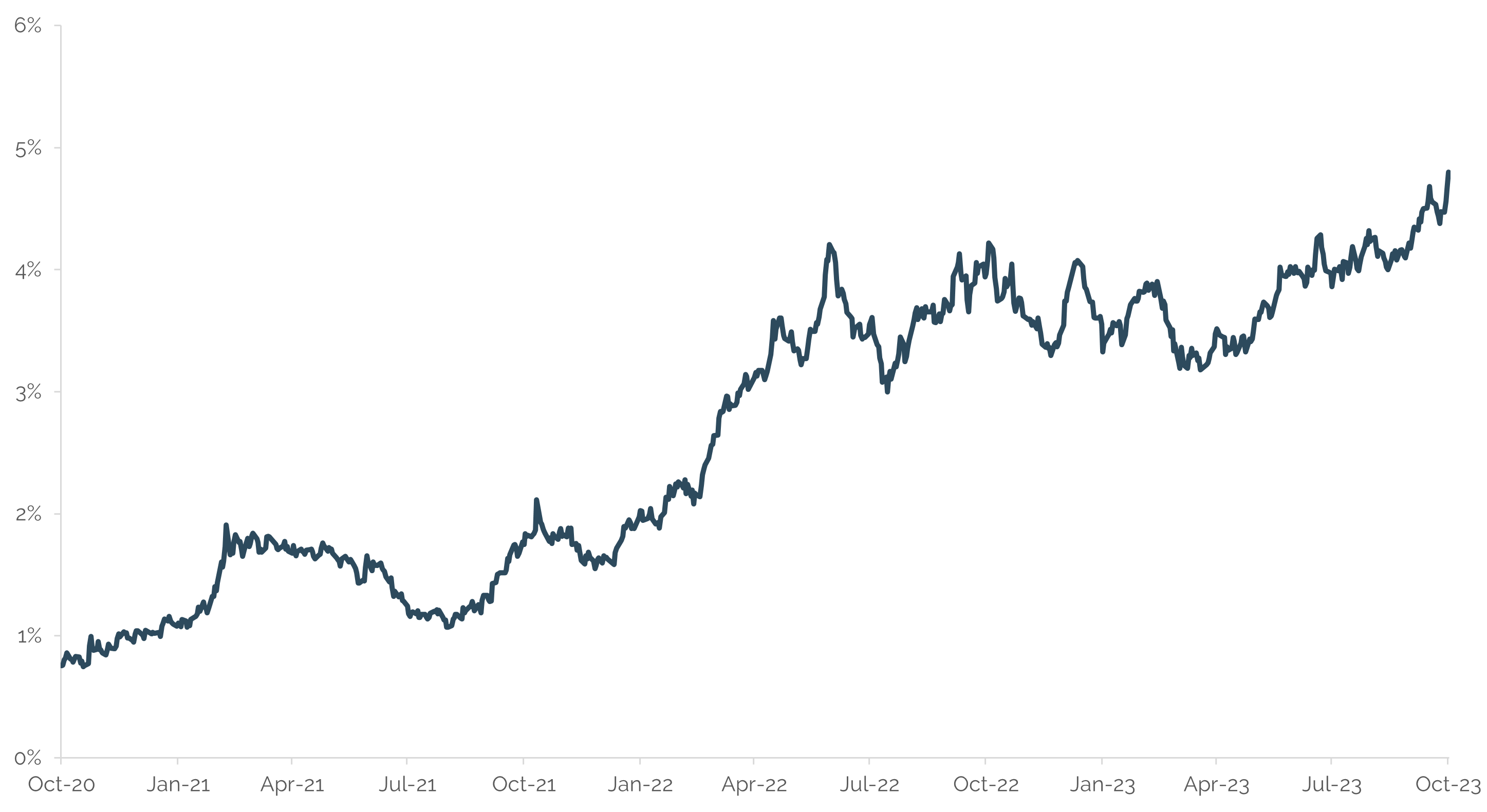

The yield on 10-year Australian government bonds was 1.5% two years ago, increasing to 3.8% one year ago and to 4.8% today1. An investor allocating $100 to ostensibly safe, stable fixed-rate Australian government bonds two years ago would be facing a $21 loss of capital today. Invest $100 one year ago and it’s a $3 hit to capital today.

A 21% capital loss over 2 years highlights the real risks embedded within fixed-rate government bonds. They make up the bulk of the AusBond Index, with the remainder bonds that also carry direct exposure to various companies, increasing the potential for loss when things move the wrong way.

Yield - Australian 10-year Government Bond Future

Source: Bloomberg

Active protection

Preserving capital during the recent structural shift in interest rates meant, above all else, having the flexibility to move out of fixed rate bonds completely when yields were low, and risk was high. That flexibility also means adding fixed-rate bond exposure at the right time, when outright yields more than compensate for the interest rate risk.

Funds that must always take fixed-rate bond risk, or always floating-rate bond risk, can only ever thrive under certain conditions. The Enhanced Yield Fund is deliberately structured for flexibility, able to move in and out of risks when it makes sense.

When rates were very low the Fund held almost entirely floating-rate assets, both preserving capital and earning higher coupons as interest rates rose. Now the Fund is adding some interest rate risk, particularly shorter-dated bonds that we believe pay outsized yields for the risk. There are also excellent businesses out there, mispriced or misunderstood, that the Fund adds to further contribute to performance.

In this environment, more than ever, active bond management pays dividends.

About the Author

David Murray is a Senior Credit Analyst at PM Capital, a leading asset manager of global and Australian equities and fixed income.

1 Source: Bloomberg, 19 Oct 2023. 10-year Australian government futures contract XM1 used to represent Australian government bonds.

This insight is issued by PM Capital Limited ABN 69 083 644 731 AFSL 230222 as responsible entity for the PM Capital Enhanced Yield Fund (ARSN 099 581 558, the ‘Fund’). It contains summary information only to provide an insight into how we make our investment decisions. This information does not constitute advice or a recommendation, and is subject to change without notice. It does not take into account the objectives, financial situation or needs of any investor which should be considered before investing. Investors should consider the Target Market Determinations and the current Product Disclosure Statement (which are available from us), and obtain their own financial advice, prior to making an investment. The PDS explains how the Fund’s Net Asset Value is calculated. Past performance is not a reliable guide to future performance and the capital and income of any investment may go down as well as up.