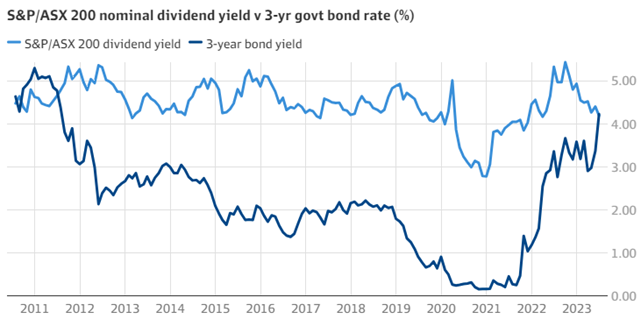

The risk reward equation in financial markets has changed. As can be seen in the chart below, the yield on the Australian 3 year government bond is now essentially the same as the average cash dividend yield on the Australian share benchmark ASX200 index – which carries a much higher level of risk than the effectively “risk free” rate of the government bond.

We haven’t seen this dynamic in markets for over 10 years, and it stands out to us as another reason why adding fixed rate bonds to the Enhanced Yield Fund is a sound strategy longer term. The days of near zero government bond yields are likely long gone, and we think investors are once again being rewarded for locking in fixed interest rates of 3 years or less.

This strategy of adding shorter dated fixed rate investments to our Enhanced Yield Fund portfolio has contributed meaningfully to its current gross yield to maturity of ~5.5%.

Source: Bloomberg, Australian Financial Review

About the Author

Jeff Brown is a Credit Analyst of the PM Capital Enhanced Yield Fund.

More information on the PM Capital Enhanced Yield Fund is available here. Alternatively, see more insights related to the Enhanced Yield Fund here.

This insight is issued by PM Capital Limited ABN 69 083 644 731 AFSL 230222 as responsible entity for the PM Capital Enhanced Yield Fund (ARSN 099 581 558, the ‘Fund’). It contains summary information only to provide an insight into how we make our investment decisions. This information does not constitute advice or a recommendation, and is subject to change without notice. It does not take into account the objectives, financial situation or needs of any investor which should be considered before investing. Investors should consider the Target Market Determinations and the current Product Disclosure Statement (which are available from us), and obtain their own financial advice, prior to making an investment. The PDS explains how the Fund’s Net Asset Value is calculated. Past performance is not a reliable guide to future performance and the capital and income of any investment may go down as well as up.