Portfolio Manager of the Enhanced Yield Fund, Jarod Dawson, reports on 2020 - a turbulent year for fixed income markets.

The COVID-19 pandemic has triggered the sharpest macro-economic slow-down in generations, prompting unprecedented fiscal and monetary responses, and for many companies creating the largest individual threat to cash flow and balance sheets since the Global Financial Crisis – for some even longer.

The pandemic again highlighted the measured and methodical approach that is required to invest successfully within fixed income markets.

As we noted in our COVID-19 update in March, the Enhanced Yield Fund (EYF) was well positioned coming into this period of market volatility. Consistent with our long held contrarian theme we held high levels of cash pre-COVID-19 (when many were investing aggressively) as it was our view that markets were already expensive.

Leading into March, the EYF had been holding a substantial cash exposure of around 50%, helping to limit the impact of the Covid-19 chaos on the portfolio. Moreover, we also had an additional 10-15% of the Fund in assets that were technically not cash, but given their conservative, short dated nature behaved like cash.

The upshot was that we had plenty of available capital up our sleeve coming into the crisis that could be quickly deployed into attractive investment opportunities. We were in the enviable position of being a net buyer, rather than a forced seller, like many funds in the market.

Rather than looking for short term wins, we took a rational and methodical approach to new investments. Over the years, we have built our detailed investment research process around identifying businesses that we believe to be among the best in their relevant industries, targeting companies that we think are in a good position to be able to handle various levels of economic activity over the longer term, and who can deliver us an attractive level of return for a given level of risk.

With this in mind we ignored the short term noise, instead focussing on companies’ underlying fundamentals, and the valuations at which they were trading. Interestingly, while we seek out long term gains, the short term focus of markets has meant that in some instances, returns that we thought would come over years, have in fact been delivered in just months.

Over the past few months we have taken the opportunity to invest aggressively when others were fearful, in industries and themes that we feel have, from a valuation standpoint, been too harshly treated by investors. These investments have included the travel industry (airports and airport services), consumer facing companies such as Visa and Seek, Financials such as ANZ and Allied Irish Bank, and Australian Government inflation linked bonds which at one point were pricing in almost zero inflation for the next 10 years!

In the March quarter we made a number of significant investments, increasing the invested position of the Fund by around 20% during the worst of the pandemic. We have since sold a number of these investments due to significant price appreciation.

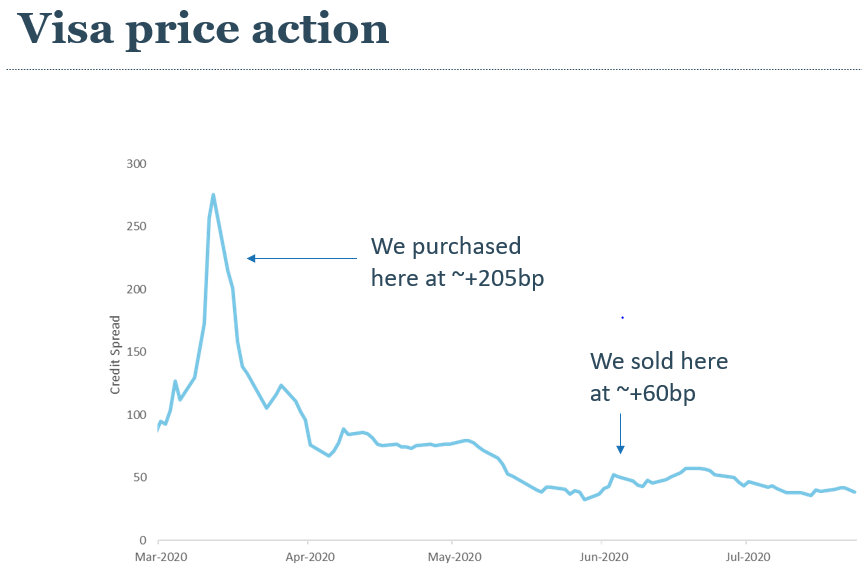

Of particular note, in March we initiated a new position in the 5-year senior bonds of global payments powerhouse Visa. Adjusted for the cash on their balance sheet Visa effectively has no net debt, still generates considerable revenue in the current environment, and will benefit from the huge bounce in activity once the pandemic subsides. As a result of the considerable dislocation in credit markets, Visa’s yield premium above cash increased five-fold from ~+0.40% to over +2.00% (where we bought it) - a AA-rated business priced like a BBB!

We also purchased a position in BHP’s 4-year senior bonds. With market concern around global demand for iron ore (mostly from China) plus Saudi Arabia and Russia quarrelling over oil production, BHP’s risk premium above cash increased markedly from ~+50bp to ~+220bp (where we bought it in April). This valuation was close to where the senior bonds traded in late 2015/early 2016 when iron ore prices fell to around $40/ tonne (~$80 / tonne at the time of investment and now sitting at around $100 per tonne) and the oil price fell below $30/ barrel. BHP owns some of the best low cost mines in the world and has almost no net debt.

Additionally, we purchased the 4-year senior bonds of French industrial services company SPIE. With market leading operations concentrated in France and Germany, SPIE installs electrical networks/ lighting, heating and ventilation, Telecoms and IT into office buildings, factories, data centres and hospitals to name a few. They operate on long term contracts, and have considerable market share in their areas of expertise. Prior to the virus outbreak, their risk premium above cash was approximately +1.5%. We bought their bonds at a staggering ~4.5% above cash.

The June quarter brought a different, but still very attractive, set of opportunities.

Firstly, the qualities of Visa and BHP were recognised by the market. As can be seen in the above chart, Visa rallied considerably as the US Federal Reserve’s bond buying program benefitted highly rated companies, and markets again started paying attention to Visa’s strong balance sheet and sound cashflow dynamics – supported by a boost in online spending while people were stuck at home (partly offsetting the drop in more mainstream spending patterns.) This saw Visa’s credit spread return to its pre-COVID-19 level of cash +~60bp – representing an ~8% return in just over two months, and thus we sold our holding.

We also divested our holding in BHP’s senior debt, as, per the chart above, it too benefitted from central bank buying of high quality names, and again, the market turned its attention back to its strong balance sheet and very supportive commodity market dynamics – particularly in iron ore. We realised a ~6% return from this investment in just a few months.

While we are more than happy to take these short term wins, we have been primarily focussed on building a portfolio designed to deliver over the medium to longer term.

Consistent with this, we initiated positions in the senior secured debt of a number of high quality airports over the past few months, at spreads which are two to three times their pre-COVID-19 levels – which we think represent clear anomalies longer term. While the pandemic has obviously had a significant impact on the number of flights entering and leaving airports, these businesses are very well capitalised, have strategically important hard assets with monopolistic qualities, and are now trading at valuations which we feel don’t reflect the significant bounce in traffic that we are likely to see over the next 12 months or so. We think this theme has the potential to contribute significantly to performance over the next couple of years, and indeed, it has already started to contribute meaningfully.

As an extension of this theme, we also purchased the senior debt of AAA-rated and government- owned Air Services Corp (ASC). ASC is a monopoly business which is responsible for basically all of Australia’s air traffic control operations. ASC traded at cash ~+50bp prior to the spread of COVID-19. We purchased their bonds at cash + ~125bp – almost three times their pre-virus valuation. We think this investment could ultimately generate a 10%+ return as valuations continue to normalise.

Apart from our new airport and air services theme, we also made an investment in the US Dollar (USD) subordinated debt securities of ANZ Bank during the quarter. While at the time we felt that Australian Dollar major bank subordinated debt was cheap, the true stand out (and thus the anomaly) were the USD bonds – as a result of “home bias” (ie where a company’s securities tend to trade more cheaply outside of their home country where they are not as well known). We purchased ANZ’s USD bonds at a yield of cash + ~280bp (compared to its pre-pandemic spread of cash +~150bp). Similarly, we also added to our position in Allied Irish Banks’ senior debt at cash + ~270bp – almost double their pre-crisis valuation.

Looking back over the near 20-year history of the EYF, one of the Fund’s often overlooked achievements has been its relatively short time to recovery during periods of market stress. During the GFC, the longest it took to recover a negative month was 3 months, during the European Debt Crisis it was 1 month, and we have already regained all negative mark to market performance as a result of the Covid-19 pandemic. We think this clearly demonstrates the discipline and effectiveness of the Funds investment strategy, and our willingness only to invest ours and our clients hard earned capital when true valuation anomalies are on offer.

We are by no means done in terms of adding new anomalies to the portfolio, as we continue to find new places to invest capital at very attractive levels. We are applying an investment process that has been tried and tested over almost two decades – through periods such as the global financial crisis in 2008/09, the European banking crisis in 2011/2012, the China growth scare in 2015/16, and Brexit and US/ China trade friction from 2017-2019. Despite all of these periods of volatility, the EYF has consistently delivered on its performance objectives. With our current portfolio, and the opportunities that we are currently researching, we are confident (all other things being equal) that we can continue to deliver on these objectives into the future, and indeed, with the ONCE IN A GENERATION valuations that we have made some of our recent investments at, we are very optimistic about the Fund’s outcomes going forward.

More on the Enhanced Yield Fund

This note is issued by PM Capital Limited ABN 69 083 644 731 AFSL 230222 as responsible entity for the PM Capital Enhanced Yield Fund (ARSN 099 581 558). It contains summary information only to provide an insight into how we make our investment decisions. This information does not constitute advice or a recommendation, and is subject to change without notice. It does not take into account the objectives, financial situation or needs of any investor which should be considered before investing. Investors should consider a copy of the Product Disclosure Statement which is available from us, and seek their own financial advice prior to investing. Past performance is not a reliable guide to future performance and the capital and income of any investment may go down as well as up.