Union Pacific – Norfolk Southern – Transcontinental merger unleashing the power of US Rail

By Kevin Bertoli

PM Capital recently initiated a position in Union Pacific (NSYE: UNP) the largest listed and in our view the best-run freight rail operator in the United States. Our investment thesis is anchored in the company’s irreplaceable network, strong competitive position, and a merger catalyst that could reshape the economics of US rail.

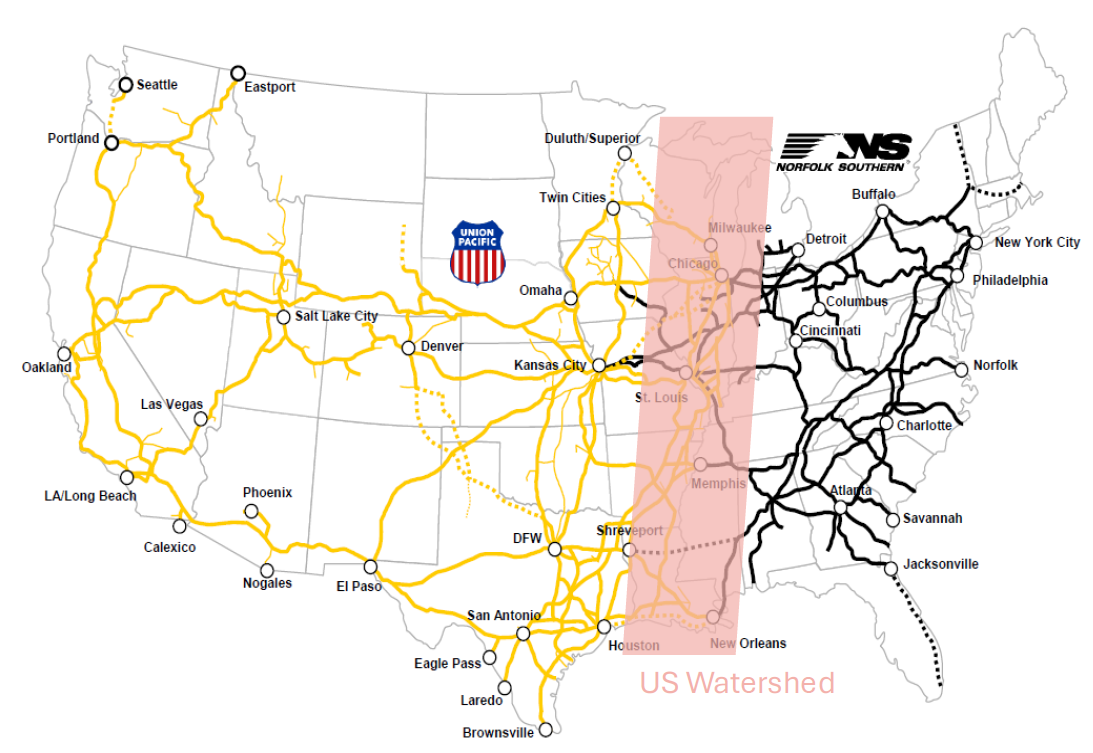

Union Pacific operates the largest freight rail network in the US among listed peers, spanning the entire western region from the Pacific Coast to Chicago and the Mississippi River. Its 50,000 plus mile network connects major West Coast ports, including Los Angeles and Long Beach, to inland hubs such as Chicago and New Orleans, making Union Pacific a critical link in global supply chains.

From a revenue perspective, intermodal - including automotive traffic, is Union Pacific’s largest contributor at over 30%. Intermodal refers to the movement of freight in containers using both rail and truck without unloading cargo. Union Pacific has a strong intermodal business given its connections to the US West Coast as well as Mexico. Its longer average haulage distance also makes its intermodal offering more competitive with trucking.

Agricultural commodities such as grains and fertilisers, energy, chemicals and plastics are also meaningful revenue contributors for the business. These commodity segments are underpinned by captive customers, industries where rail is the only economically viable mode for bulk transport.

Union Pacific’s proposed merger with Norfolk Southern represents a transformative moment for the industry. If approved, it would create the first coast-to-coast rail network in the US, eliminating interchange friction and unlocking new efficiencies across supply chains. The transaction is not just about scale; it is about redefining how freight moves across the continent.

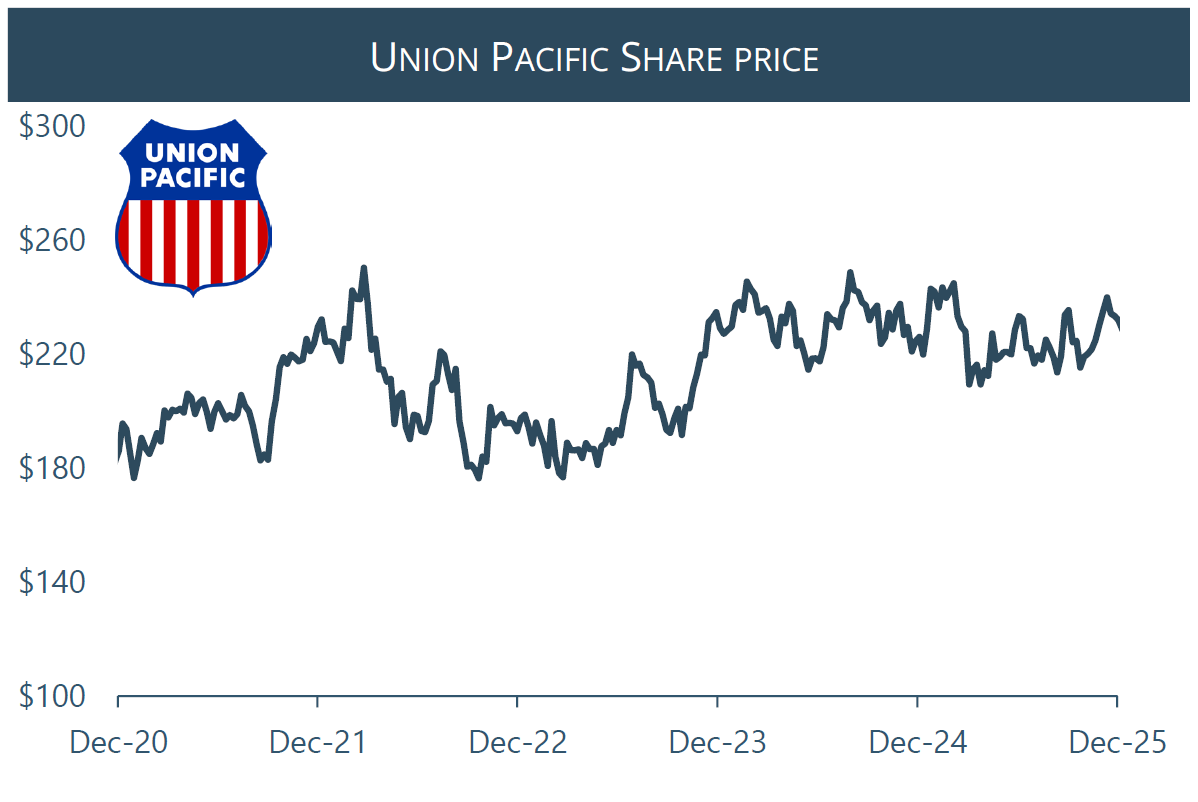

Source: FactSet, December 2025. Past performance is not indicative of future performance.

US Rail Industry

The first freight rail line in the US was completed in the early 1830s. The Baltimore and Ohio Railroad spanned a total of 13 miles. The industry reached its peak after World War 1 with more than 1,500 US railroads operating and employing more people than any other industry.1 Titans of US industry, Vanderbilt, Gould and Carnegie built their fortunes on control of US rail assets.

From the Great Depression onwards, the rail industry has seen dramatic consolidation, to the point where today the network is largely organised into two duopolies. Union Pacific and BNSF Railway (owned by Berkshire Hathaway) dominate the western US, while Norfolk Southern and CSX control territory east of the Mississippi River. These four Class I operators handle most long-haul freight in the country. Two Canadian rail operators have networks in the US however, these run primarily North – South from Chicago - to the Gulf Coast and Mexican border, rather than East – West.

A unique feature of the industry is that the rail networks are owned outright by the operators with limited access granted to third-party freight carriers. These rights are held in perpetuity, creating an infrastructure moat that is virtually impossible to replicate today due to the cost and complexity.

Another key distinction is that rail pricing in the US is not regulated. Unlike utilities, railroads have the freedom to set rates, which combined with captive customers and few viable alternatives have enabled consistent annual price increases of 2–3%.2 Pricing resilience, alongside high barriers to entry, creates meaningful protection for operators.

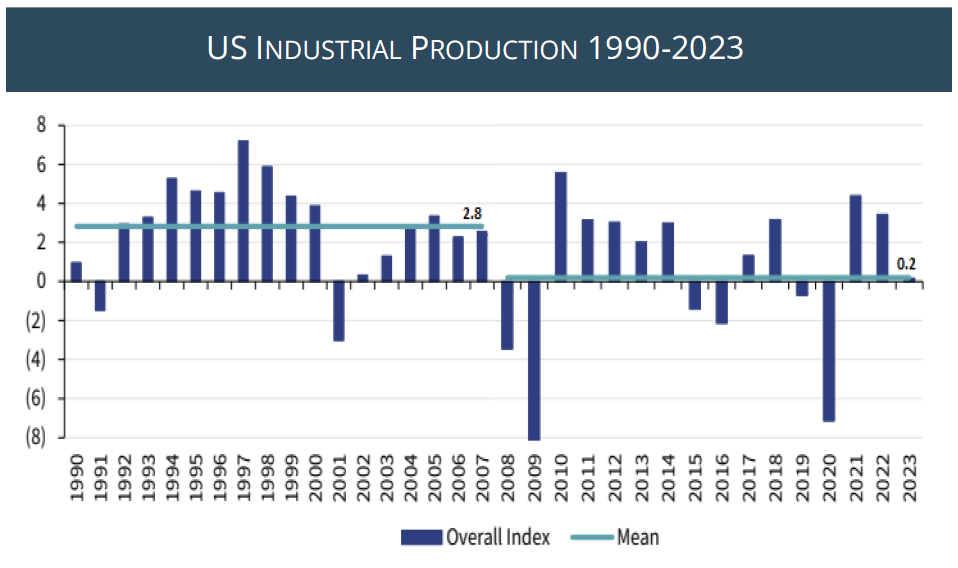

For much of the past two decades, growth in US rail profits has not come from hauling more freight. Volumes have been broadly flat, in line with US industrial production, which has also shown little growth over the same period.3 The industry has had to offset not only stagnant industrial volumes but also a structural decline in coal shipments. Thermal coal usage has fallen sharply, with Union Pacific’s coal volumes down roughly 65% over the past decade. Yet, railroads delivered double digit compound earnings growth since the GFC through three levers, pricing power, efficiency gains and capital allocation.

Source: Rothchild & Co Redburn, 2024

First, pricing. The duopoly structure and captive customer base have allowed railroads to push through annual price increases even during periods of weak industrial production.

Second, efficiency. The adoption of Precision Scheduled Railroading (PSR) transformed the operating model. By rationalising networks, reducing dwell times and running longer trains on fixed schedules, railroads lowered operating ratios from ~80% in the early 2000s to the low 60% today. These improvements unlocked significant margin expansion and elevated returns on invested capital (Union Pacific sits at 16–17%, the highest in the industry).4

Third, capital allocation. Aggressive share repurchases have amplified EPS growth. Even with stagnant volumes, the combination of pricing, margin gains, and buybacks delivered double-digit annual EPS growth across much of the last decade.

The Transcontinental Merger Proposal

One of the biggest structural inefficiencies in the US rail system is the absence of a true transcontinental operator. Today, freight moving from coast to coast must interchange between eastern and western railroads creating delays, added costs, and complexity for shippers. This fragmentation limits rail’s competitiveness versus trucking and constrains supply chain efficiency. Rail interchange typically occurs where networks meet - broadly aligned to the Mississippi River (often referred to as the Watershed) and in Chicago.

Union Pacific’s proposed combination with Norfolk Southern aims to solve this problem. Announced on the 29 July 2025, the deal would create a coast-to-coast network spanning the continental US. CEO Jim Vena captured the strategic intent during the call to announce the transaction:

“When I came back to work at Union Pacific, I carried around a black folder with my thoughts. There’s something missing in the United States of America—and that is truly a transcontinental railroad. We limit the capability of customers and manufacturing and supply chains because of the handoffs we do. The difficulty was always, could you ever get a deal done and have a partner?”5

The rationale is clear, eliminate interchange friction, reduce dwell times, and offer customers a seamless transcontinental service that does not exist today.

Our research - indicate that for merchandise and intermodal shipments rail becomes cost competitive versus trucking once haulage distance exceeds 1,000 miles. Two issues emerge for rail, that of rail being short hauled on one side of the interchange (i.e. having a shipment of less than 1,000 miles) or a scenario where goods are being transported between markets which lie less than 1,000 miles either side of the interchange (ie Dallas to Georgia). In the first case, the short hauled railroad needs to compete aggressively with trucking to capture the volume. This has led to uneconomical volumes being forfeited to trucks. In the second scenario, shipments along these routes typically fall exclusively to trucks as both rail operators are effectively short hauled.

A unified UP–NSC network would unlock these lanes, converting truck traffic to rail and creating a true transcontinental product.

Outlook

At our entry price in September 2025 of $220 per share, on a standalone basis Union Pacific trades at roughly 17x CY26 consensus earnings estimate* and a 5.5% free cash flow yield.6 We consider this reasonable given the quality, irreplaceable nature of its assets. However, for valuation to rerate from these levels the company (and the industry more widely) needs to be able to grow volumes consistently so that earnings growth becomes less reliant on pricing and operational efficiency gains.

The real upside lies in the merger with Norfolk Southern. This potential merger is not just another deal; it marks a strategic pivot for an industry that needs a new growth engine. By creating the first transcontinental rail network, Union Pacific is positioning itself to capture structural tailwinds from reshoring, supply chain integration, and modal shifts from truck to rail. The first transcontinental rail network has the potential to unlock volume and earnings growth not seen in decades.

Union Pacific’s management has guided to $1.75 billion in revenue synergies, though we believe to be conservative. If synergies materialise as expected, EPS could reach $18+ by 2028, free cash flow could rise to $12 billion, and buybacks of $10 billion per year could resume. In that scenario, the market may re-rate UP from today’s 18–20x multiple toward 24–25x7, in line with faster-growing industrial peers.

About the author

Kevin Bertoli is co-Portfolio Manager of PM Capital’s Global Companies Fund and Australian Companies Fund. PM Capital is a leading asset manager in Australian and global equities, and interest rate securities. More PM Capital Insights are available here.

1 https://www.aar.org/wp-content/uploads/2020/07/AAR-Chronology-Americas-…;

2 Union Pacific Company Annual Reports. Union Pacific Revenue per car load over entire business is 2.5% (does not take into consideration mix) per annum over the last 5yrs.

3 Rothchild & Co Redburn, 2024

4 Union Pacific Company Annual Reports

5 Union Pacific, Business Update Call/ Announcement of Norfolk merger proposal, 29 July 2025

6 FactSet 2025

7 FactSet 2025

Disclaimer

This information is issued by PM Capital Pty Limited (ACN 637 448 072) (‘PM Capital’), a corporate authorised representative of Regal Partners (RE) Limited (ACN 083 644 731, AFSL 230222) (‘Regal Partners RE’). Regal Partners RE is the Responsible Entity and issuer of PM Capital Global Companies Fund (ARSN 092 434 618) and has authorised the release of this information. PM Capital and Regal Partners RE are wholly owned subsidiaries of Regal Partners Limited (ACN 129 188 450, ASX:RPL) (‘RPL’) (RPL and its subsidiaries are referred to together as ‘Regal Partners’).

This information is subject to copyright and any use or copying of the information in it is unauthorised and strictly prohibited. All figures are in USD, unless stated otherwise.

Past performance is not indicative of future performance. All investments contain risk and may lose value. The objective and past returns of PM Capital Global Companies Fund (ARSN 092 434 618) are expressed after the deduction of fees and before taxation. The objective is not intended to be a forecast and is only an indication of what the investment strategy aims to achieve over the medium to long term. While we aim to achieve the objective, the objective and returns may not be achieved and are not guaranteed. Certain statements in this information may constitute forward looking statements. Such forward looking statements involve known and unknown risks, uncertainties, assumptions and other important factors, many of which are beyond the control of Regal Partners, and which may cause actual results, performance or achievements to differ materially (and adversely) from those expressed or implied by such statements.

This information has been prepared for general information purposes only and without taking into account any recipient’s investment objectives, financial situation or particular circumstances (including financial and taxation position). The information does not (and does not intend to) contain a recommendation or statement of opinion intended to be investment advice or to influence a decision to deal with any financial product, nor does it constitute an offer, invitation, solicitation or commitment by Regal Partners. You should consider the product disclosure statement (‘PDS’), prior to making any investment decisions. The PDS and target market determination (‘TMD’) can be obtained on this website. If you require financial advice that takes into account your personal objectives, financial situation or needs, you should consult your licensed or authorised financial adviser. This information is only as current as the date indicated, is subject to change without notice and may be superseded by subsequent market events or for other reasons. Regal Partners does not guarantee the performance of any fund or the return of an investor’s capital. None of Regal Partners or its related parties, employees or directors provide any warranty of accuracy or reliability in relation to this information and to the extent permitted by law, Regal Partners disclaims all liability (including liability for negligence) for direct or indirect loss or damage suffered by any recipient acting in reliance on this information.

Regal Partners RE, other members of Regal Partners or funds managed or advised by them may now, or in the future, have a position in any securities which are referred to in this information. Such positions are subject to change at any time without notice.