Grupo Mexico shines on copper strength

By Kevin Bertoli

Rally in mining and rail conglomerate reinforces PM Capital’s investment approach

Key points

- Grupo Mexico holds majority stakes in Southern Copper Corp and GMexico Transportes, the dominant freight rail operator in Mexico.

- Through Southern Copper, Grupo Mexico is leveraged to favourable long-term dynamics in the copper market.

- GMexico Transportes can benefit from ‘reshoring’, as more manufacturing returns to North America.

- Grupo Mexico continues to trade at a discount to the value of its holdings in Southern Copper and GMexico Transportes, providing, in our view, a cheaper entry point to Southern Copper’s earnings and dividend streams.

Introduction

Listed on the Mexican Stock Exchange (BMV), Grupo Mexico SAB de CV is one of Mexico’s largest listed companies, capitalised at M$1.15 trillion (US$62.5 billion).1

Grupo Mexico derives most of its value from two main assets. The first is an 88.9% stake in Southern Copper, a US-listed copper producer (NYSE: SCCO) and one of the world’s largest copper producers.2 Mining and metals is by far Grupo Mexico’s most important division, contributing 84% of the company’s net profit.3

The second is a 72% stake in GMexico Transportes, Mexico’s largest rail freight operator (BMV: GMXT).4

PM Capital initiated a position in Grupo Mexico in 2H-2023 at an average entry price around M$82 per share. At the time, the company traded at a significant discount to the market value of its holdings in Southern Copper Corp and GMexico Transportes.5

This discount was, and still is, largely due to Grupo Mexico’s conglomerate structure – multi-division firms often attract a lower multiple for their earnings and cash flow – and the perception that cash flow from the core Southern Copper and GMexico Transportes business may be diverted into new business areas driving greater business complexity.

Grupo Mexico’s large discount to in the value of its Southern Copper stake offered us an alternative way to express our favourable long-term view on copper supply and demand fundamentals.

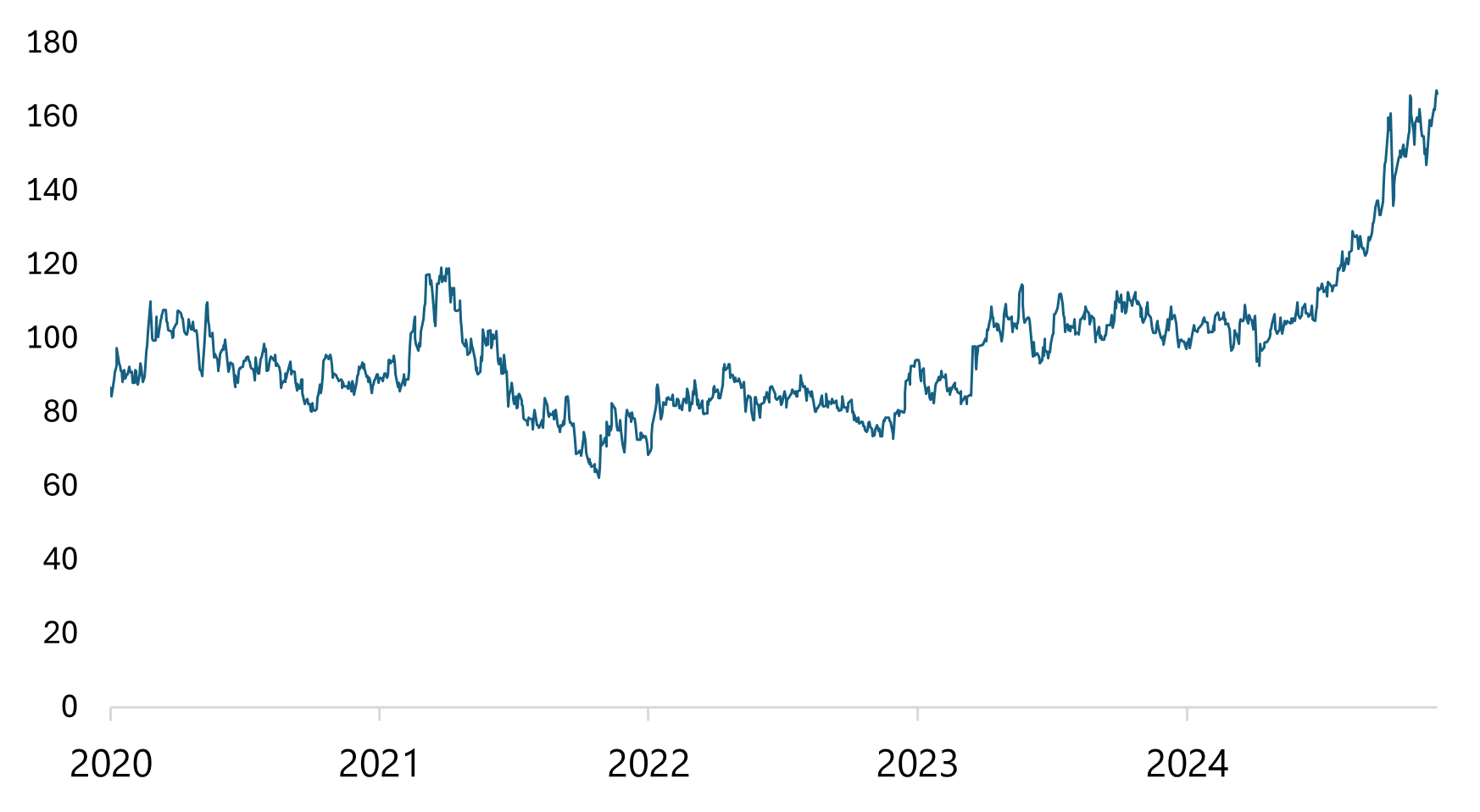

Grupo Mexico has been a strong contributor to performance this year amid gains in the copper price6 and as the market reassesses copper’s strategic value in a environment where global economic decoupling, commodity security and resource scarcity becoming greater priorities, as Chart 1 below shows.

Chart 1: Grupo Mexico share price (pesos)

Source: PM Capital Five years to 5 December 2025. Past performance is not indicative of future performance.

Three factors continue to support our positive view on Grupo Mexico:

1. Copper and commodity weaponisation

Copper has been a key theme for PM Capital and the source of several successful portfolio positions this decade.7 By commodity, copper is the largest portfolio exposure.8

In late 2019 and 2020, we initiated positions in leading global copper companies, anticipating a rise in the copper price due to underinvestment in new supply of copper and ongoing supply disruptions to copper production.

On the demand side, copper is an essential material in electric vehicles and renewables infrastructure. The growth in renewables was expected to support the copper price.

Our positive view on copper has been strengthened amid geopolitical developments since President Trump began his second term this year.

Heightened global tensions and the shift from a unipolar global economy (dominated by the US) to a multipolar one (with regional hegemons) has sparked renewed recognition of the importance of commodities in economic development. From copper to uranium, rare earths and battery metals, commodities are becoming increasingly powerful tools in economic warfare.

We believe this dynamic could disrupt commodity markets and add another element to the demand-supply equation, potentially creating opportunities for long-term investors.

This trend has been playing out with copper this year. President Trump’s administration argued that the dominance of a single copper producer threatens US national security and economic security, later imposing tariffs on copper imports.9

The US clearly recognises not only the supply side constraints emerging in key commodities but also the fact that the US has become beholden to foreign countries for supply – unlike China who has spent the last decade developing key resources in Africa, largely a result of the One Belt-One Road initiative. While the US wants to encourage domestic independence of key metals, such as copper, through greater US-based minerals production the reality is this is a long-term policy that will take years to evolve while supply constraints are emerging today.

PM Capital’s positive long-term thesis on copper remains firmly intact. We expect supply shortages to emerge as this decade progresses due to a lack of new projects, to offset growing demand from both traditional sources and emerging sectors such as renewables, electric vehicles and AI infrastructure. Ultimately demand and supply will match, and the release valve will be price.

However, there is also a growing risk that prices could experience short term spikes, much like we are seeing now. Given markets are extraordinarily tight, with low inventories, supply outages at major mines can have a more material impact. This has been the case in 2025 with major mine outages at including Freeport McMoRan’s Grasberg mine in Indonesia, Ivanhoe’s Kaluka Kamoa in the DRC and Codelco’s El Teniente in Chile. Reduced output from these mines compound upon the impact of closures at Cobre Panama and declining grades and production at BHP’s Escondida, one of the largest mines in the world. Together, these mines accounts for a high-single-digit share of global production.

2. Rail operations

Through GMexico Transportes, Grupo Mexico has a leading position in Mexico’s freight rail market.10 GMexico Transportes contributed 13% of Grupo Mexico’s net profit in 2024.11

The Mexican rail industry is a duopoly comprising GMexico Transportes and Canadian Pacific Kansas City a Toronto-listed rail operator (TSE: CP). Unlike US freight rail companies that own the majority of US tracks, Mexico’s two main operators operate under long-term government concessions. GMexico Transportes’ key concession runs until mid-2050, with exclusivity until the mid-to-late 2030s.

Earlier this year, Grupo México announced plans to privatise GMéxico Transportes following a period of lacklustre share price performance, which we believe was primarily due to its very low free float and limited liquidity. Shareholders approved the delisting plan in June 2025. Subsequently, Grupo México launched a public acquisition offer to repurchase outstanding shares at M$33.50. It is anticipated that the delisting will occur before year-end and Grupo Mexico’s shareholding will rise.

The global trend towards near-shoring and reshoring – where offshore companies move more of their supply chain back to their home country due to heightened global risks – favours GMexico Transportes’. Reshoring is another favoured trend of PM Capital.

GMexico Transportes’ should provide a stable, growing earnings stream to the consolidated Grupo Mexico business. Freight rail penetration remains low in Mexico, with trucks accounting for about three quarters of freight transportation market – a trend that suggests potential for rail to grow its market share, particularly through better integration with US Class I rail operators.12

Greater integration of Mexican rail freight into Northern American rail networks is positive for GMexico Transportes’. In 2023, Canadian National and Union Pacific, two key Northern American rail operators, partnered with GMexico Transportes’ to create an intermodal service between points in Mexico, Canada and the US (through Chicago).

3. Valuation

As mentioned earlier, Grupo Mexico continues to trade at a discount to the value of its underlying holdings in Southern Copper and GMexico Transportes.

Chart 2 below shows this discount over the past five years. The blue line represents Grupo Mexico’s enterprise value (equity plus net debt). The red line shows the combined enterprise value of Southern Copper and GMexico Transportes’. The yellow bars at the bottom of the chart track the valuation discount.

Chart 2: Grupo Mexico’s valuation discount

Source: PM Capital, FactSet. Past performance is not indicative of future performance.

Two things stand out. First, Grupo Mexico consistently trades at a discount to the value of its underlying assets. Second, the discount significantly widened in the 2H-2023 due to fears around capital allocation outside the core business units – a key reason we initiated a position in the stock.

A comparison with Southern Copper is also telling. At current spot commodity price (US$5/lbs copper price), Southern Copper trades at approximately 23 times its FY25 earnings, our analysis shows. In contrast, Grupo Mexico trades at approximately 14 times FY25 earnings, even though it owns 89.9% of Southern Copper and the business accounts for the vast majority of earnings.

Conclusion

Grupo Mexico reinforces PM Capital’s investment processes to scour the world for companies that provide exposure to its favoured themes, in this case, copper and manufacturing reshoring in the US.

Grupo Mexico also highlights PM Capital’s approach to identify assets trading at bottom-quartile valuations due to short-term volatility or irrational market pricing.

Through Grupo Mexico, PM Capital has exposure to Southern Copper at a lower valuation multiple (compared to investing in Southern Copper directly).

Finally, PM Capital’s view on copper emphasises our long-term approach. Our positive thesis on copper is based on multi-year commodity cycles. We view any weakness in the copper price as a potential opportunity to add exposure to a metal that has favourable prospects over this decade – a strategy reflected in our Grupo Mexico holding.

About the author

Kevin Bertoli is co-Portfolio Manager of PM Capital’s Global Companies Fund and Australian Companies Fund. PM Capital is a leading asset manager in Australian and global equities, and interest rate securities. More PM Capital Insights are available here.

1 Source: Google Finance. Market capitalisation and currency conversion at 15 October 2025.

2 Southern Copper Corporation, Form 10-Q, United States Securities and Exchange Commission, Sept 30, 2024, p.8.

3 Grupo Mexico 2024 Annual Report, p.13.

4 Source: https://www.gmexico.com/en/Pages/corporatestructure.aspx Accessed 15 October 2025.

5 Based on internal PM Capital analysis.

6 The USD copper price has risen from about US$4 a pound on 1 January 2025 to US$$5.12 a pound at 14 October 2025. Source: Trading Economics.

7 PM Capital’s copper positions include Freeport McMoRan, Teck Resources, Capstone Copper and Grupo Mexico.

8 Refers to PM Capital’s Global Companies Fund. At 30 September 2025.

9 Presidential Actions, ‘Addressing the Threat to National Security from Imports of Copper’. The White House. 25 February 2025.

10 GMexico Transportes’ earned 61% of national rail freight revenue in Mexico in 2024. Its main competitor earned 39%. Source Fitch Ratings. 25 November 2024.

11 Grupo Mexico 2024 Annual Report, p.13.

12 Source Fitch Ratings. 25 November 2024.

Disclaimer

This information is issued by PM Capital Pty Limited (ACN 637 448 072) (‘PM Capital’), a corporate authorised representative of Regal Partners (RE) Limited (ACN 083 644 731, AFSL 230222) (‘Regal Partners RE’). Regal Partners RE is the Responsible Entity and issuer of PM Capital Global Companies Fund (ARSN 092 434 618) and has authorised the release of this information. PM Capital and Regal Partners RE are wholly owned subsidiaries of Regal Partners Limited (ACN 129 188 450, ASX:RPL) (‘RPL’) (RPL and its subsidiaries are referred to together as ‘Regal Partners’).

This information is subject to copyright and any use or copying of the information in it is unauthorised and strictly prohibited.

Past performance is not indicative of future performance. All investments contain risk and may lose value. The objective and past returns of PM Capital Global Companies Fund (ARSN 092 434 618) are expressed after the deduction of fees and before taxation. The objective is not intended to be a forecast and is only an indication of what the investment strategy aims to achieve over the medium to long term. While we aim to achieve the objective, the objective and returns may not be achieved and are not guaranteed. Certain statements in this information may constitute forward looking statements. Such forward looking statements involve known and unknown risks, uncertainties, assumptions and other important factors, many of which are beyond the control of Regal Partners, and which may cause actual results, performance or achievements to differ materially (and adversely) from those expressed or implied by such statements.

This information has been prepared for general information purposes only and without taking into account any recipient’s investment objectives, financial situation or particular circumstances (including financial and taxation position). The information does not (and does not intend to) contain a recommendation or statement of opinion intended to be investment advice or to influence a decision to deal with any financial product, nor does it constitute an offer, invitation, solicitation or commitment by Regal Partners. You should consider the product disclosure statement (‘PDS’), prior to making any investment decisions. The PDS and target market determination (‘TMD’) can be obtained on this website. If you require financial advice that takes into account your personal objectives, financial situation or needs, you should consult your licensed or authorised financial adviser. This information is only as current as the date indicated, is subject to change without notice and may be superseded by subsequent market events or for other reasons. Regal Partners does not guarantee the performance of any fund or the return of an investor’s capital. None of Regal Partners or its related parties, employees or directors provide any warranty of accuracy or reliability in relation to this information and to the extent permitted by law, Regal Partners disclaims all liability (including liability for negligence) for direct or indirect loss or damage suffered by any recipient acting in reliance on this information.

Regal Partners RE, other members of Regal Partners or funds managed or advised by them may now, or in the future, have a position in any securities which are referred to in this information. Such positions are subject to change at any time without notice.