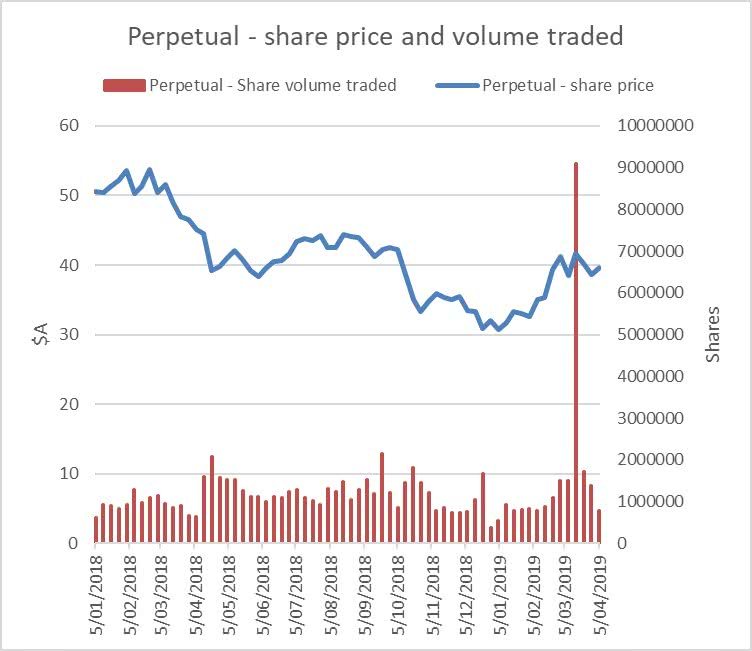

Recently the share price of market stalwart Perpetual suddenly spiked over 12% in the space of four days. What was the fundamental reason? There wasn’t one, writes Portfolio Manager John Whelan.

The sharemarket regulator, the ASX, asked Perpetual what was behind the surge. Perpetual’s succinct response? Nothing. It came up with a few historical matters but nothing that would explain the not insignificant share price gain, on large volume.

The Financial Review, however, came up with a possibility: that an index fund that concentrates on investing for yield had been forced to buy the stock. As Perpetual had been newly included in an index that measures the performance of high dividend stocks, an exchange traded fund (ETF) that invests to match that index waded into the market to ensure it held the stock.

As at end February, the index fund held no Perpetual stock as the company wasn’t represented in the index at that time. In contrast, as at end March Perpetual was the sixth largest holding in the ETF, with A$130 million invested[1].

The sum total of this is that within a month an index fund had bought the stock, not because it thought the fundamentals of the stock looked bright, but because it had produced a good dividend yield in the past and was now part of a high dividend stock index.

The stock started to rise at the beginning of February, probably assisted by speculation that it was going to be included in the index and therefore had to be bought. And so it was, at a 25% premium to where it was the month prior.

In effect, the ETF had basically bid against itself to get the holding it required to satisfy an index requirement.

This cost will not show up in the ICR of the ETF itself or when an adviser compares the returns of the ETF with the relevant index. By purpose it is meant to match the index as close as possible.

The bigger question lies in comparative returns. Someone has to pay for buying a stock at a significant premium. This is the ETF and its unitholders. When determining the success or failure of an investment strategy it needs to be considered against the returns available alternatively in the broader universe, ie, the opportunity cost. The cost here is significant and will take some time to be made up for by a good yield.

What about if the situation changes and Perpetual falls out of the index? If the ETF sells, what are the chances that it will be able to get out of the market without depressing the price? In such a situation the investor loses on the way in, and loses on the way out.

This is an example of asset allocation via index funds that investors may need to re-think, particularly where pre-determined asset mixes are based on set sectors underpinned by index funds.

Want more insights and updates? Subscribe below.

This article reflects opinions as at the time of writing and may change. PM Capital may now or in the future deal in any security mentioned. It is not investment advice.

[1] https://www.blackrock.com/us/individual/products/239499/ishares-international-select-dividend-etf