The market focuses on Teck’s past and overlooks its progress.

By Alex Warnaar, PM Capital

In late July 2022, Teck Resources announced that longstanding CEO Don Lindsay would retire. The second-quarter earnings call – Lindsay’s 71st such call - would be his last. Jonathan Price, a former BHP Group executive who joined Teck in late 2020, would succeed Lindsay.

The announcement formally marks a new era for Teck and exemplifies the wider change across the company. The once hydrocarbon-focused miner is growing its base-metal operations, the balance sheet is less indebted, and shareholder distributions are now top-of-mind. Changes the careful observer noticed several years ago are now becoming apparent to the wider market.

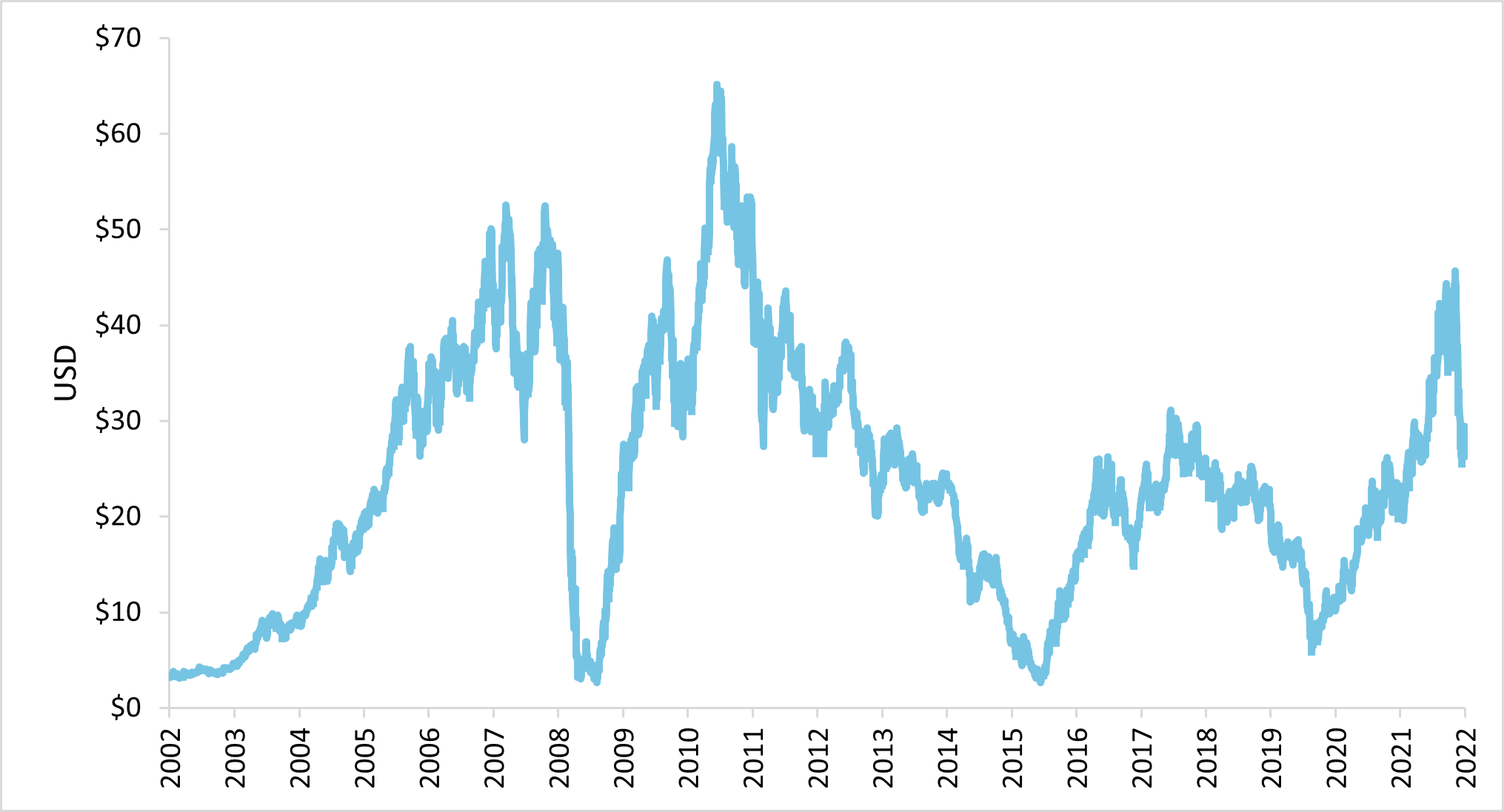

To understand how the market viewed Teck in the old era, consider its stock price history: Teck traded at the whim of commodity markets, from one extreme to the other. On various occasions Teck entered market downturns too indebted and its stock fell precipitously.

Teck Resources share price chart

Source: Factset

First was the Global Financial Crisis in 2008 and 2009, a period during which commodity prices were low and Teck’s balance sheet was in trouble. It is fitting that towards the end of Lindsay’s farewell earnings call he thanked the then Board Chairman Norman B. Keevil for his support at the time.

The second occasion was the resources bust in 2014 and 2015 which coincided with Teck beginning investment in the Fort Hill oil sands mine in Canada.

In 2005, Teck acquired 15% of the planned mega-project in northern Alberta1. New to the company at the time, Lindsay said the oil sands project would add a long-life business to Teck’s copper, zinc, and metallurgical (steelmaking) coal operations. The project was shelved at the onset of the Global Financial Crisis and only progressed in 2014, just as the oil price peaked. Fort Hills eventually produced its first oil in 2018, but the damage was done. Teck ultimately wrote down the value of its Fort Hills investment and reported significant losses from the business in 2020 and 2021.

With heavy capital investment and no free cash flow, the market began to question Teck’s management and governance. Teck’s dual-class voting structure gave a small group of shareholders (principally Norman B. Keevil and family) control of just over 40% of Teck’s voting power, despite having only a 1% economic interest2. The dual class voting structure added to negative market sentiment.

Teck’s metallurgical coal exposure created other problems. The market saw Teck as a ‘coal company’ despite copper and zinc assets contributing about half of its earnings. In 2016, many US-based coal companies went bankrupt or teetered on bankruptcy, only to repeat the same mistakes in 2020 and 2021. Fewer investors wanted to own coal stocks on Environmental, Social and Governance (ESG) grounds, and many did not care to distinguish between thermal coal, used for power generation, and metallurgical coal, used for steelmaking.

In 2020, negative market sentiment and volatility in Teck’s stock price provided PM Capital an opportune entry point below US$8 dollars per share, a point at which Teck had a market capitalisation of roughly US $4 billion. In the following 24 months, Teck’s steelmaking coal business alone generated earnings above $4 billion.

Management succession

Despite the ups and downs, Lindsay hands over to Price a business in excellent shape to move forward.

Teck’s metallurgical coal mines make it the world’s second-largest seaborne exporter and provide geographic diversification in an industry where production is centred around Queensland and subject to weather events. Teck produces high-quality coal at an operating margin not too far behind that of industry leader BHP.

In base metals, Teck’s Red Dog operation in northwest Alaska is one of world’s largest, and lowest-cost, zinc mines. Antamina, a high-altitude Peruvian copper mine, is also top-tier asset and as Lindsay once alluded to, has provided exceptional returns for two decades.

Quebrada Blanca II (QB2), Teck’s new Chilean mine that is due to produce first copper within the next six months, provides a second large-scale copper operation in the Americas.

Among recent changes, in late 2020 Lindsay & Teck’s Board appointed Harry ‘Red’ Conger, a former executive at copper miner Freeport-McMoRan, as Chief Operating Officer. Red brings to Teck decades of experience and a reputation for delivering large mining development projects.

Windfall earnings in metallurgical coal leave Teck’s balance sheet clean, and management have made clear that the Fort Hill oil sands asset will ultimately belong to a different owner. Major capital expenditure is nearly complete and shareholder distributions, both dividends and buybacks, have started in earnest.

Further ahead, Teck will look to expand QB2 and has several promising base-metal projects set for development this decade. Potential projects include the San Nicolas copper project in Mexico, which has the earliest potential; the proposed Zafranal copper-gold project in southern Peru; and the Galore Creek project in Canada. Galore Creek, a joint venture with Newmont Mining Corp, is one of the world’s largest undeveloped gold-silver-copper deposits. Teck may use a similar joint venture approach across its projects to reduce development risks and free up its balance sheet.

Teck’s base-metals development pipeline provides the company with potentially peer-leading production growth towards the latter half of the decade, a time in which we believe the market underestimates the long-term supply constraints. A lack of viable projects, especially within the large miners that are most capable of building them, should underpin higher copper prices, for longer3.

The story is similar in metallurgical coal. While Teck is not growing coal production, it should be enough to merely maintain production to benefit from the lack of new supply. Global steel demand will edge higher with economic growth and industrialisation, but industry wide seaborne exports are below historical levels. Seaborne metallurgical coal supply barely responded to the record prices reached in the first half of 2022.

The onerous royalties on coal production announced by the Queensland government in June 2022 only reduce the industry’s incentive to invest. Increasingly, new coal production has been left to smaller mining companies with high costs of capital and a lack of wherewithal to manage through cyclical downturns. Unlike previous commodity cycles that were largely demand driven, we expect the coming cycle will be driven as much by supply constraints.

Turning point

In Teck Resources, PM Capital sees a company at an inflection point. Teck has an excellent mix of assets and growth options abound at a time of structural supply shortages. Teck Resources’ tailwinds are strong, and it is up to new management to capitalise on them.

In coming years, we hope new CEO Jonathan Price takes - and we think he will - a balanced approach that uses the excellent cash flow from the metallurgical coal business for shareholder distributions, while carefully growing the company’s base metals operations. Growth should be structured and timed, such that bringing on a new mine is not an all-or-nothing bet, does not stretch the balance sheet, and does not consign Teck’s stock price to, in Lindsay’s words, the penalty box.

As it stands today, Teck has top-quartile assets but a bottom-quartile valuation. In the new era, Teck ultimately has the potential to re-rate higher and trade as a top-tier diversified mining company.

1 Teck had a 21.3% interest in the project as of August 2022.

2 Keevil family ownership is via entity Temagami Mining Co Ltd.

3 PM Capital also invested in copper miners Freeport-McMoRan, Frist Quantum Minerals and Oz Minerals. We trimmed positions in early to mid-2021.

This insight is issued by PM Capital Limited ABN 69 083 644 731 AFSL 230222 as responsible entity for the PM Capital Global Companies Fund (ARSN 092 434 618) and the PM Capital Australian Companies Fund (ARSN 092 434 467), the "Funds". It contains summary information only to provide an insight into how we make our investment decisions. This information does not constitute advice or a recommendation, and is subject to change without notice. It does not take into account the objectives, financial situation or needs of any investor which should be considered before investing. Investors should consider the Target Market Determinations and the current Product Disclosure Statement (which are available from us), and obtain their own financial advice, prior to making an investment. The PDS explains how the Funds' Net Asset Value are calculated. Past performance is not a reliable guide to future performance and the capital and income of any investment may go down as well as up.